Relative strength momentum has become very popular as an investment strategy. It is a relatively simple strategy and has been the driver of most of the equity momentum work, buy recent winners and sell recent losers as a long/short portfolio. This is not really a trend-following strategy because the focus is on relative performance and not on the time series movement in stocks.

There has been research work on time series momentum which is more akin to classic trend-following. This has also been shown to be profitable albeit it has not been subject to the same amount of testing as relative strength momentum. Now there has been work on another variation of momentum – absolute strength, which provides another take on the theme which accounts for trend behavior.

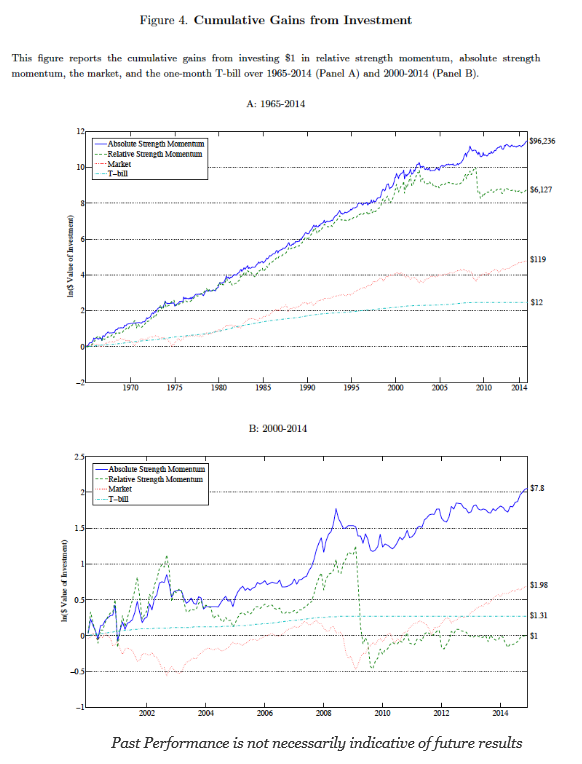

The absolute strength momentum looks at portfolios of winners and losers based on breakpoints of past absolute strength performance. It is not based on relative performance or recent momentum but on relative performance versus the distribution of all past performance. See “Absolute Strength: Exploring Momentum in Stock Returns” by Huseyin Gulen and Ralitsa Petkova. The thesis of the work shows that large absolute price movements in one direction in the recent past continue in the same direction in the future.

Stock returns higher (lower) than the 90th (10th) percentile of the historical return distribution of all stocks over past ranking periods earn positive (negative) returns. Buy winners and sell losers based on past absolute strength. This approach combines recent information on cumulative returns with historical distribution of cumulative returns. What is notably is that the breakpoints for the 90th and 10th percentile are relatively stable over long time periods. This measure will be similar to relative strength moment when the current distribution of cumulative returns is similar to the historical distribution of returns.

While this is a different take on momentum, it can provide some support for the most general trend following rule of buying winners and selling losers. The measure is conditional on the historical distribution of performance and will not take positions of winner that are not in the extreme, but it shows that absolute strength supports the concepts of performance (trend) following.