When I hear about diversification across funds or strategies, I, like most investors, will immediately focus on the correlation matrix versus other alternatives and asset classes. However, investors should be thinking beyond the simple historical numbers and focus on forward expectations for correlations. There should be views of how diversification may change through time or behave under different scenarios. To form diversification or correlation forecasts, investors should have a classification scheme for diversification. All diversification is not alike and a classification scheme may help with determining how correlation may move.

For example, if an investor asks for a strategy that has diversification to protect in a crisis, they have embedded a forward view of what they would like to see the correlation to look like under an extreme scenario. There are also placing a weight on the likelihood of a crisis that may drive a correlation disruption.

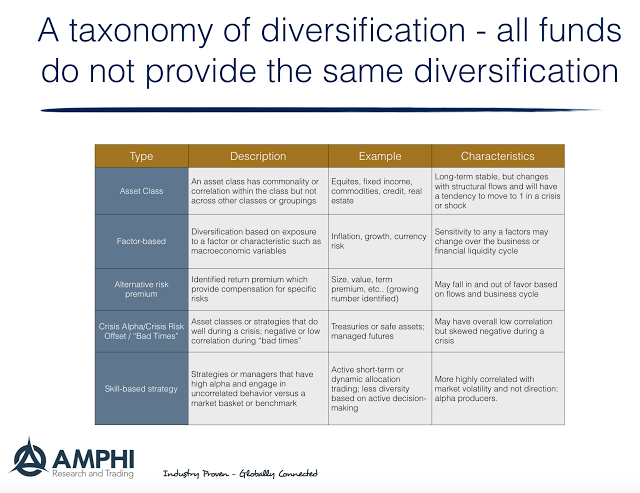

More generally, the correlation of an asset class or a fund is based on the sensitivities to different factors or risk premiums. A simple taxonomy of diversification could breakdown a market, manager, or strategy into five different types or buckets. The easiest diversification classification is an asset class. However, asset class correlation can change with the business, cycle, investment flows, and in a crisis. The simplest and perhaps best diversification currently is the negative relationship between stocks and bonds; however, there have been long periods when this correlation has actually been positive. Any diversification strategy has to account for the fact that the negative stock bond correlation is not definitive.

A second type of diversification is based on factors. Factor-based diversification is often confused with alternative risk premiums. Our view is that a factor could see some macro variable or characteristics that been be correlated to an asset class, market or strategy. Simple examples of a factor-based diversification will be sensitivity to inflation or economic growth. The alternative risk premium diversification may include sensitivities to value, size, term premium, or credit to name some classics. Some of the have proved to move and out of favor.

A separate category of the asset class/factor/risk premium diversification is the crisis alpha type of strategies which have low or negative correlation during “bad times”. These scenario-based diversifiers could be safe assets or a strategy that will take advantage of market turbulence or diversification.

A final type of diversification is from those managers who are alpha producers or who focus on short-term strategies that will not be dependent on the overall longer-term direction of a market or risk factor. I will call this skill-based diversification. It can be hard to find but may prove stable relative to many forms of diversification based on macro factors.

This taxonomy just scratches the surface on an issue that if fundamental to asset allocation but is critical to an attempt to maximize portfolio return to risk. While portfolio diversification has often been called the only free lunch of investments, this freebie can be enhanced through some thought on the form of diversification across scenarios.