“Enough with this diversification talk. I’ve got my 60/40, and I am happy!” The 60/40 stock/bond portfolio mix has become a standard reference or benchmark for many investors, yet its performance versus a truly diversified portfolio is mixed.

The Case for Diversification

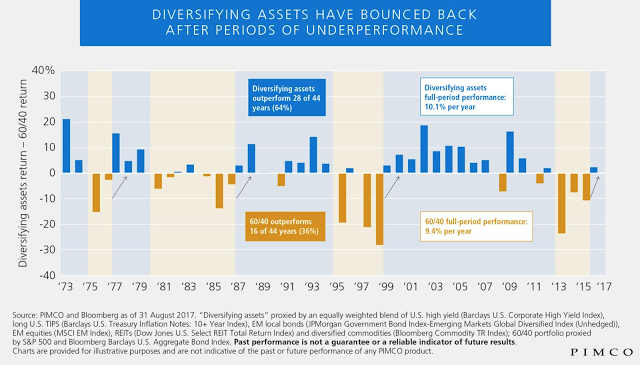

The diversified portfolio present above (high yield, TIPS, EM bonds, EM equities, REITs, and commodities equally weighted) is just one alternative diversifying mix of assets; nevertheless, the sample above shows that an equal-weighted portfolio will do better than a 60/40 stock/bond mix (S&P 500/Barclays Agg) about 2/3rds of the time. You could say that the positive opinion towards the 60/40 blend is a recency bias, with it outperforming a diversified basket in four of the last five years, not including the partial 2017 year.

Historical Context

The periods when there have been extended outperformance of the 60/40 blend relative to the diversified portfolio have been centered when there has been equity overvaluation in the US markets: mid-80s before the 1987 crash, late ’90s before the tech bubble, and the more recent period when US stocks have seen significant gains in asset inflation.

Strategies for Beating 60/40 in the Long Run

There are several ways to beat the simple 60/40 blend in the long run. One, add diversifying assets from the list used in the graph above. However, the excess return was based on the fully diversified portfolio versus the 60/40 blend. Two, add hedge fund strategies that have diversification of assets along with diversification of style. This, for example, could be a portfolio of managed futures programs that are already globally diversified across a broad set of markets, including equities, bonds, rates, currencies, and commodities. Along with asset class diversification, investors get strategy diversification that often weighs long and short positions by trends. The advantage of managed futures is the opportunity for adding convexity or portfolio gamma.

The Return-to-Risk Combination

Combining a robust US stock market with diversification from bonds has made for a triumphant return-to-risk combination. Still, as we have seen, there are no guarantees that this combination will always do well. Further diversification will better manage risk and allow for higher returns, especially after periods of one-sided performance.