The Wall Street talk is that all markets are over-valued, yet any valuation has to be placed in context. For fixed income, this is not easy given you have to make a judgment on both the real rate of return and expected inflation. Additionally, there is a need to measure the term premium associated with bonds. The premium measures the compensation necessary for investors to hold longer duration bonds versus a series of successive short bonds given the volatility and uncertainty associated with real rates and inflation. The term premium is not directly observable and is difficult to measure but has intuitive appeal.

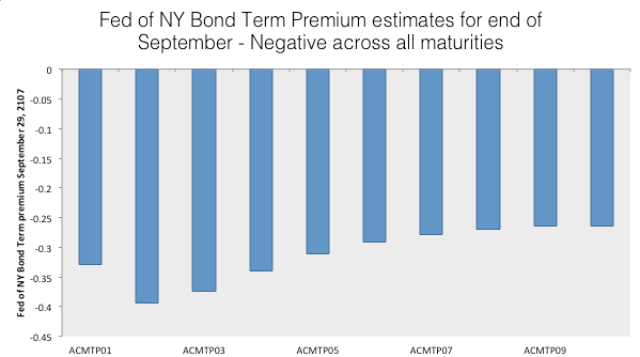

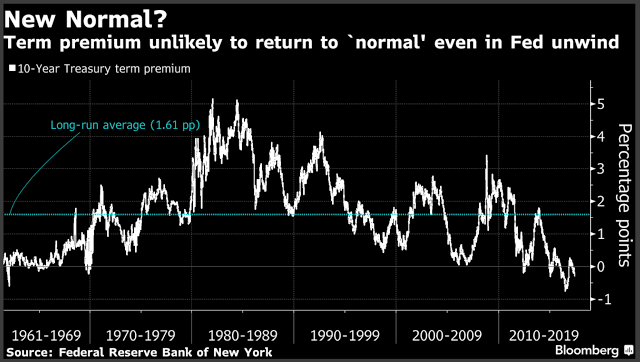

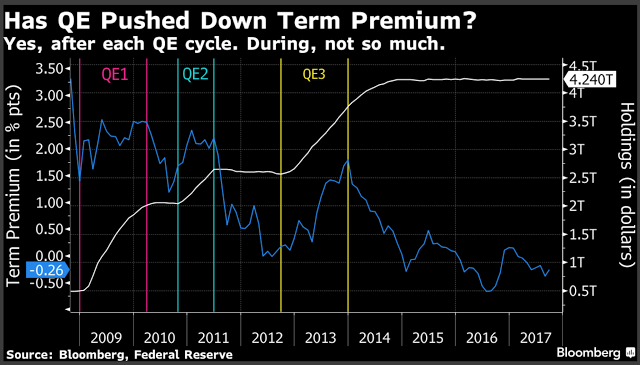

The Fed of New York provides their estimate of the term premium on a daily basis for different maturities along the yield curve. The premium will change with market conditions but it has been falling since the period of maximum uncertainty in the early 1980’s. The term premium has really been declining since the Fed bond buying in their QE programs. Now all of the term premiums are negative. Granted volatility is lower and the Fed has controlled short rates, but a key driver is the expanding balance sheet of the Fed. The Fed as a marginal buyer and one of the top holders of Treasuries has led to the abnormal premium condition.

Given the long-term average and current levels, it would not be unheard of to see term premiums increase well over 100 basis points not including any change in expectations on the real rate and inflation. A slow Fed unwind should minimize any dramatic changes in the term, but that does not change the fact that this risk premium in on the wrong side of expectations.

Forget the sophisticated models and take a simple Bayesian approach to bond risk. Assume less Fed activity to stabilize the market through constant buying to hold balance sheet levels stable; even if you get the forecast for inflation right which over the next year could be in a range of 100 basis points and you get real rates right which also could be in the range of 100 basis points over the next year, your forecasts could be spoiled by an increase in the term premium as it moves back to normal.

Term premium adjustment is a headwind against any bondholder. Only bondholders who are short can turn this into a tailwind. A simple investment rule should be – Do not fight headwinds and don’t add to markets that may have natural reasons to go down unless your forecasts are extremely strong.