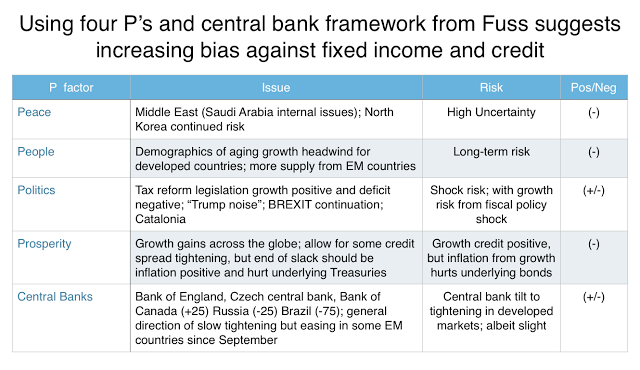

Dan Fuss, the Loomis Sayles bond guru, has been working in fixed income for decades. He has developed a set of four “P’s” with central bank behavior for looking at the macro fixed income environment and his read is suggesting that caution should be applied to any forecast that believes bonds are safe.

Many of the P factors are longer-term and associated with shocks, so it may not be trade worthy, but for investors who are looking at longer-term asset allocation, this type of checklist is valuable. We have made our own assessment and believe the tilt is away from the credit sector and should be focused on global diversification or strategies that can perform better if there is a global economic shock.