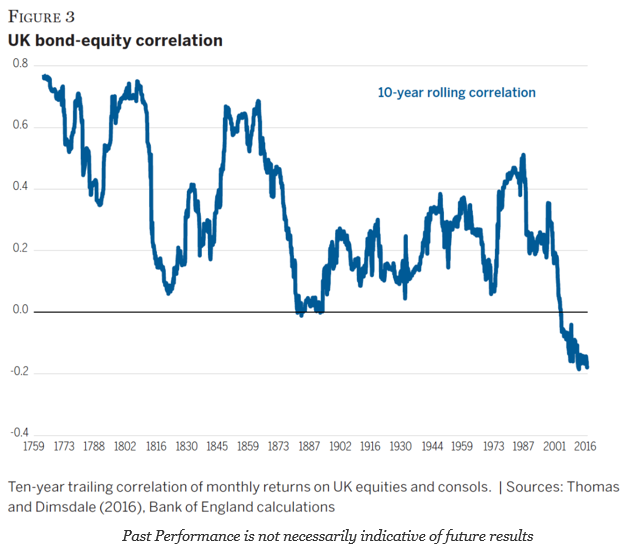

The bond diversification story is based on the strong negative correlation between stocks and bonds that has existed for over a decade, yet it is not a given that stocks and bond returns will move in opposite directions. A quick look at a very long history from a Wellington Management chart tells us that the negative correlation is the exception not the rule.

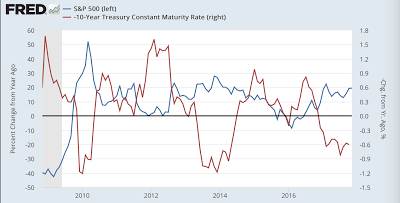

The current relationship between stock and bonds continues to follow the usual pattern with stock gains associated with bond rate increases (the chart shows rate increases as a negative change). There is little to suggest that we will see a change other than history tells us to be careful. Nevertheless, history may be a good guide to help with longer-term asset allocation.

If the stock bond correlation goes back to normal which could be above .2, there would be a sea change in portfolio volatility. Higher correlations between stock and bonds would mean a higher overall volatility as the cross-asset covariances rise.

An effective way to help offset some of that risk is to look for strategy diversification. Low correlation strategies which have higher expected returns than current bond returns would be a good fit. These alternative diversifiers would be strategies that focus on relative value or strategies that have long/short exposure across asset classes like global macro and managed futures.