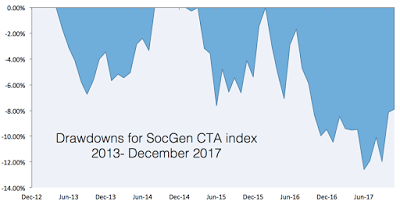

Managed futures, as a hedge fund strategy, have moved off of its max drawdown since June, its worst drawdown in the last five years, as measured by the SocGen CTA index. For some investors this type of drawdown means an exit from the strategy; however, some of the broader data on manager selection suggest a different approach. The idea of being careful about making investment decision based on a drawdown is consistent with the mean reversion performance analysis of winners and losers.

See,

“Buy the losers and sell the winners? Reverse your thinking and be careful about avoiding or exiting losers”

“Predicting managed futures returns – Follow the mean reversion”

Some things to think about before using a drawdown as a decision variable:

- Style performance is dynamic. The best (worst) style today may not be the best (worst) tomorrow. The real question is whether it has added to portfolio diversification.

- Momentum strategies have been subject to steep drawdowns. The reason so many have not gotten on the momentum bandwagon has been the strong downdrafts in performance. If a deep drawdown has occurred, there is less reason for it to be sustained.

- Trend-following success is conditional. If there is no price dispersion (trends), trend-following will not make money. Breaking down performance attribution is critical in a drawdown.

- Trend-following does better the there is greater risk-aversion or a “risk-off” environment. The last year has been a risk-on period which generally means lower returns for managed futures. A drawdown should not be surprising and investors likely made money with their risky asset portfolio.

- Managed futures as a long/short strategy will not have drawdowns based on out of favor asset classes. The turnover in the strategy suggests that any bad trade ideas have already been purged from the portfolio.

- Many managers cut leverage and thus volatility in a drawdown. There can be a debate on the efficacy of following this risk management strategy but many managers will reduce risk exposure in a drawdown and thus limit future loses.

- Data show that there is mean reversion in manager performance. See our post on the details of holding losers not winners on a go forward basis

Bad performance should not be rewarded with slow response, but the reasons for the poor performance should be studies closely. Think of all of the due diligence required for a buy decision. The same careful analysis hold be done on an exit; however, the process may have to be done much more quickly when real dollars are at risk.