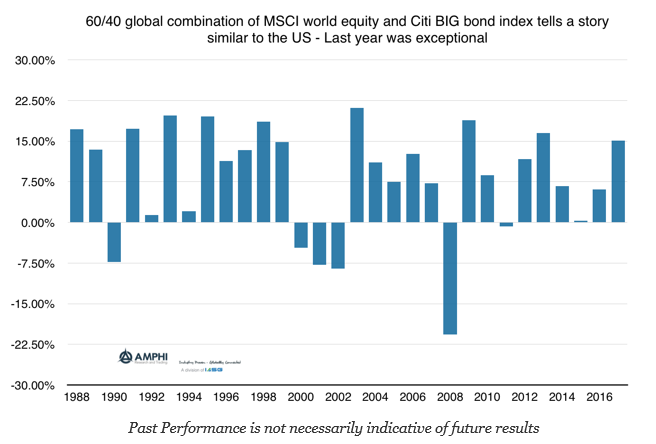

The 60/40 stock/bond combination generated an exceptional year for many investors. Although a 60/40 combination is a simplified version for the portfolio that many investors hold, it is a good representation of the general asset class mix without any accounting for alpha and manager selection. For international investors, we ran a similar 60/40 combination of the MSCI World and Citi WBIG index of world sovereign bonds.

As expected, this mix also generated double-digit returns in 2017 even with the lower global rates. The average return for this combination was 8.1% and the median was 11.23% for the last 30 years. Yet, these averages do not represent what an investor may receive in 2018.

To get even the average return, investors will either need to do better than the consensus expected return of around 6% (from Bloomberg survey for US stocks) and receive a strong positive bond return even with many yields at sub-zero levels outside the US. Rates will have to go lower even while there is talk of central bank normalization outside the US.

Stock/bond portfolio exceptionalism usually leads to the following year being more “normal”. Every year where there have been 15% portfolio returns has been followed by lower portfolio returns although not negative. Negative portfolio returns require a recession which is unlikely in 2018. Nevertheless, the need for many global investors is to match an expected return around actuarial assumptions and not just a positive return. Those expected returns are around 7%.

Expected performance suggest a story that better returns for next year will be more likely driven by holding non-traditional asset classes, finding strong alpha generators that can offset diminished beta returns, or strategies that can move across asset classes to take advantage of changing beta returns. Simple variations around a 60/40 theme will not be enough for return-demanding investors.