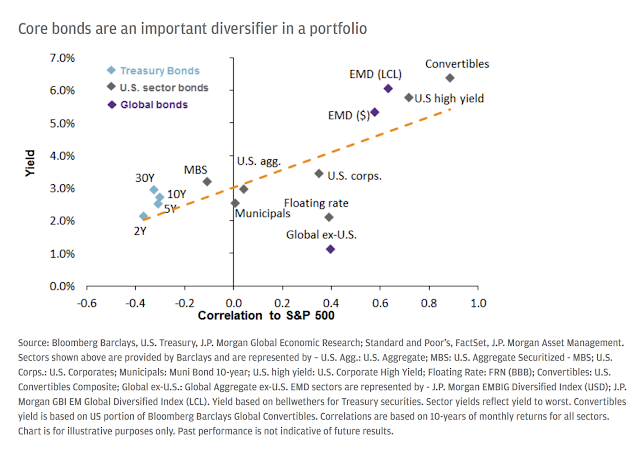

Some may say, “A bond is a bond, is a bond”. Investors may place risky assets in one category and then have bonds in a less risky category. This dichotomy does not focus on the important distinctions between bond groups and the roles that different bond categories may play nor does it present the possible trade-offs between return, risk, and correlation within a portfolio from different bonds.

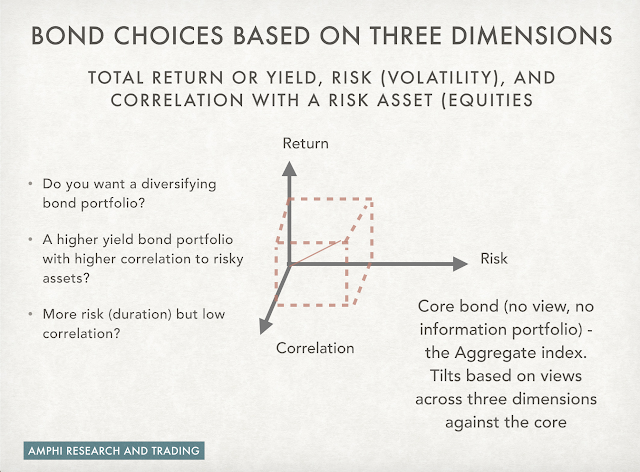

While there has been a movement to unconstrained bond funds, there have not been many good frameworks for thinking about the trade-off within the bond universe. The following graphs provide a view on the issue with bond allocation choices.

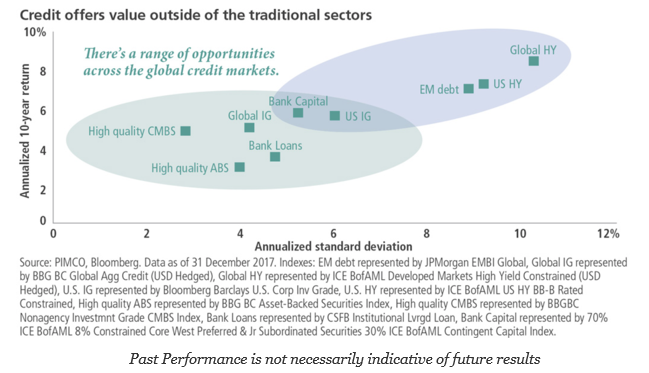

Investors can increase return in credit through holding more risk. Further refinements can be made based on duration, business cycle, and inflation. With more volatility, higher yields, and less intervention by central banks, the dispersion in bond opportunities will further increase.

One could think of the Barclay Aggregate index as the passive no information core portfolio. If there is a no view on bond categories, hold the Aggregate index. Around this fulcrum, investors can move along three dimensions, yield, risk, and correlation to equities as the risky asset.

You can have greater diversification at the sacrifice of yield. You can increase yield through holding more credit sensitive investments at the cost of more correlation with equities.

There is greater return potential with thinking about bond sector bets around a core allocation. Additionally, investors can adjust their diversification against a risky portfolio through changing bond sector exposures.