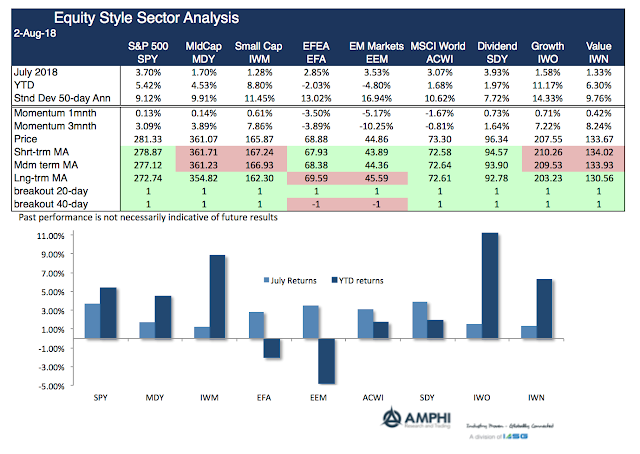

All equity style sectors generated gains for July. The EM index ETF is the only major style down for the year. Global markets outperformed more localized US markets as measured by mid and small cap indices. Growth has been the best style index this year with returns exceeding 11 percent. While performing well this month, global equities have still lagged for the year based on growth and earnings differentials versus the US. Nevertheless, there are some concerns about short-term trends in smaller cap indices as well as growth and value indices.

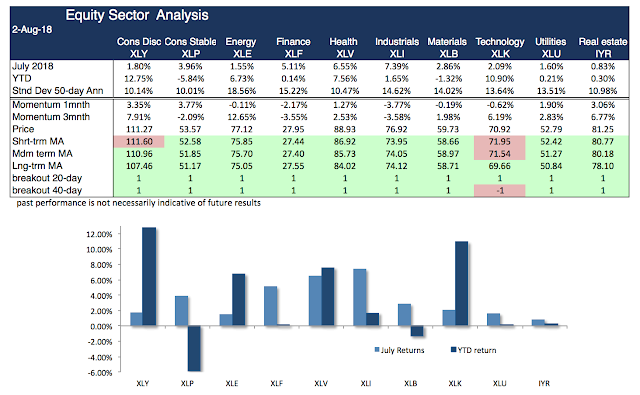

All equity sectors also showed gains for July; however, the dispersion in performance is significantly greater for year to date returns. Consumer discretionary, health, and technology are the leaders for the year. Finance, materials, and utilities are laggards. Trend models are signaling some short-term concern for the technology sector.

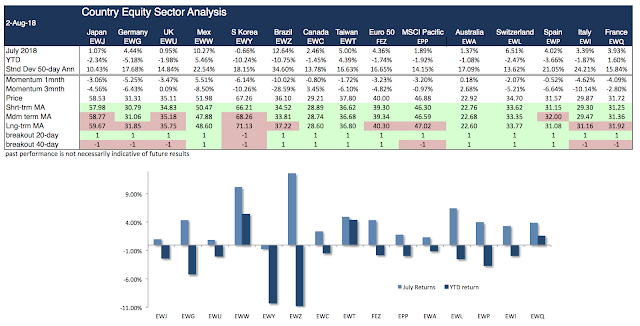

Country equity ETFs also produced strong gains for the month with double-digit returns for Mexico and Brazil. Year to date returns show high variation in returns with the average country return being negative.

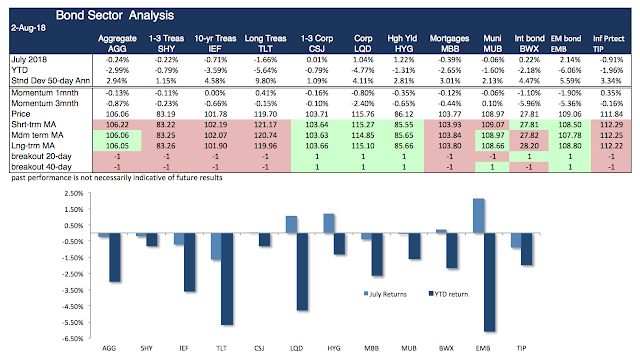

Bond performance was negatively correlated with equity returns. Long duration Treasury bond ETFs generated the poorest performance while credit sensitive and EM bonds posted positive returns consistent with risk-on behavior. Trend models signal lower returns for duration sensitive sectors. The credit sectors show upward trend signals.

The general signals for asset classes suggest being long risky asset classes and avoiding safe assets. Portfolios with equity tilts should perform well in August based on current price-based signals. Markets are looking through political noise and focusing on economic and earnings based fundamental signals.