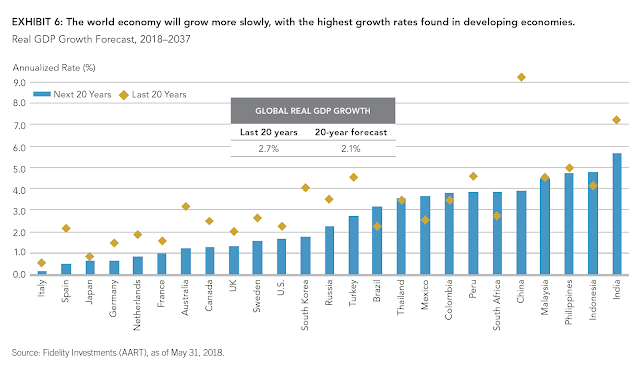

Fidelity Investments as come out with their long-term secular global growth prospects and it sobering tale of lower growth. (See Secular Outlook for Growth: The Next 20 Years.) With few exceptions, the growth for each of the countries studied will be lower. The exceptions are based on catch-up, the idea that very low productivity countries will increase productivity as they move closer to the rest of the world. These forecasts are not based on any exogenous events that will cause economic growth disruptions. They are only focused on demographics and productivity. Populations will be aging, growth rates will be slowing, and productivity is not expected to see any increases over current trends.

The conclusions from this type of forecast are very straightforward. Long-term real interest rates will be lower and there will be little tailwind for higher returns in equity. Beta trading or passive long-term investing will not receive any benefits. Expect less from your investment portfolio. Lower growth means more competition for existing firms as they fit over the sales and market share.

But, like the frog cooked under slowing rising heat, this long-term secular trend may not be noticed in any given year. Except this myth as been debunked. Frogs will notice and react. Investors can do the same. Here are some simple suggestions:

- Increase strategic allocation to emerging markets. This has been a well-discussed strategy although the failure of BRICS to perform over the last decade suggests that this is not a low risk proposition.

- Increase allocation to technology that may enhance productivity. Easy to say, but hard to implement given many technology companies may not have a direct link to overall firm productivity.

- Increase allocation to those firms that have high research and development budgets. Some researchers have viewed this investment as a key value factor.

- Look more closely at risk factor investing to move beyond simple market beta. This can be implemented today and have both short and long-term value.

- Increase focus on alternative risk premia, which focus on long/short portfolios that invest in style specific relative risk. This will enable investors to exploit relative differences across firms and countries.

None of this action has to be taken immediately, but investors can start the discussion and make strategic directional changes to account for slower secular growth.