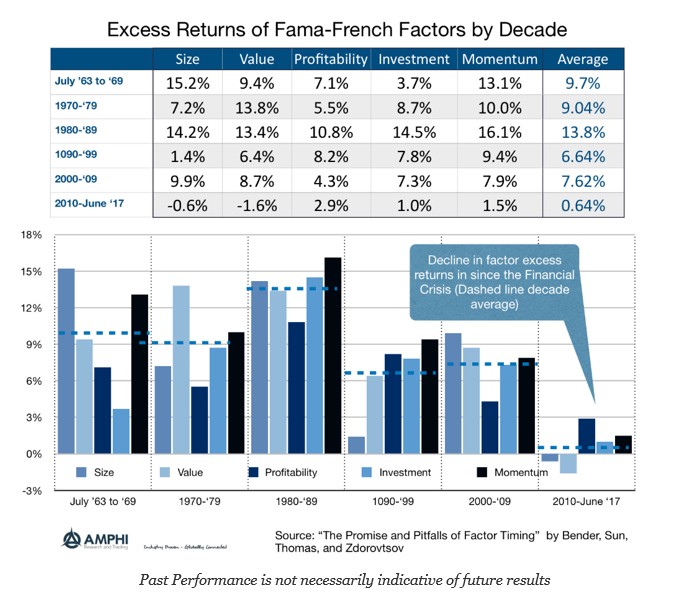

The post Financial Crisis has been an unusual periods especially when measured by factor excess returns. Simply put, there were no traditional factor returns as measured by the classic Fama-French factors. A comparison across decades show that factor returns are variable but generally positive and average from 6+ percent to just under 14 percent. The average excess returns for Fama-French factors since 2010 have been less than 1 percent. If you tried to make money playing these risk factors you got paid nothing. Since factor investing is the bread and butter of equity hedge funds, this is a clear indication why hedge fund investing has under-performed or disappointed many investors over the last few years. Forget about alpha decay, there has been limited return from investing in risk factors.

From the paper “The Promise and Pitfalls of Factor Timing”, we can see that there has been a general compression of returns associated with factor investing. If an investor wanted to play the factor investing game over the last decade, using the standard models would not have gotten you much. (We will discuss factor timing as a way to improve performance in a later post.) This is only a generalization but it provides context on whether there has been a tailwind or headwind for factor investors.

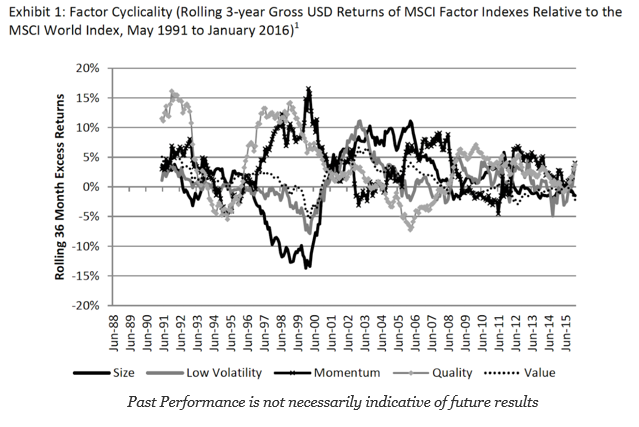

So why has factor performance been so low? Factor excess returns are usually associated with three reasons: compensation for risk, behavioral biases, and market frictions. These reasons may ebb and flow with changes in the business cycle, financial conditions, or valuations. There should be no expectation that these factors will be stable, but there is the assumption that the premia should be positive over a multi-year period.

The current data suggests there is no excess return for risk, no behavioral bias or structural return associated with these factors. Could it be that too much money is chasing these risk factors? It is only clear that we do not fully understand the dynamics of these risk factors.