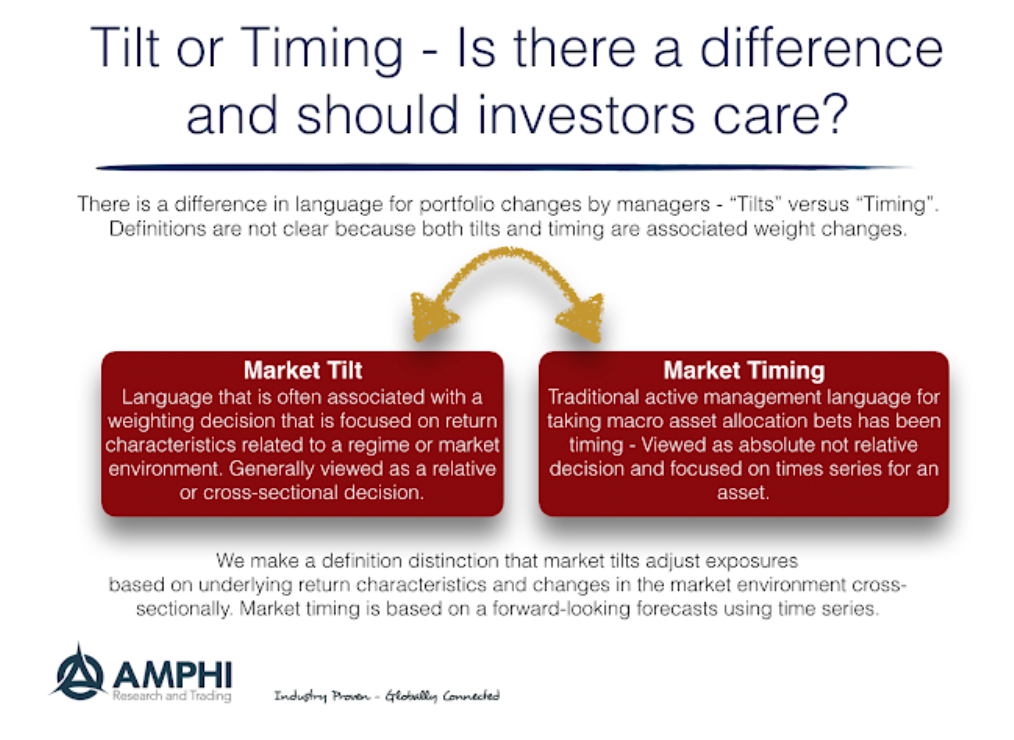

At a recent conference, I heard a large money manager say, “We do not market time, but we do take market tilts.” Unfortunately, no one was able to ask the manager to clarify the difference between tilts and timing. Aren’t they both forecasts?

I have used the phrase market tilts, but I am not sure that investors make or understand the distinction between the two concepts, timing, and tilts. Although there are subtle differences, clarification of these terms is essential.

Market timing is the adjustment of exposures in a portfolio based on forward-looking expectations. It is a time series forecast. Market tilts will be an adjustment of weightings or exposures based on the asset, strategy, or premia characteristics. It can also be a change in weightings based on the market environment regime. Market timing is analogous to trend-following, while market tilts are associated with cross-sectional analysis. Both may require some past view behavior repeating itself.

A portfolio of alternative risk premia may start with the assumption of equal volatility or equal risk contribution. There is no view about the risk premia other than they may have different volatilities. A tilt suggests that the weighting of the portfolio may differ from some volatility equalization.

The characteristics of an alternative risk premium may suggest higher returns or risk. These underlying characteristics may indicate a tilt. For example, some risk premia may underperform during different business cycle stages. Other risk premia such as FX carry will underperform when all global rates are compressed or there is a significant dislocation in international markets. Still, other risk premia may be sensitive to spikes in volatility. Some ARP are more defensive and will do better during economic “bad times.”

These conditional views may be considered forecasts but should be grouped differently than a times series performance forecast. Nevertheless, we view that tilts are forecasts and should be given the same level of care and any timing decision.