IASG, Author at IASG

Gamma Q January 2022 Market Update

Commentary provided by Todd Delay of Gamma Q Breckhurst Commodity Fund (onshore) was up a net estimate of 1.29% for January, and Breckhurst Commodity Fund (Cayman) was up a net estimate of 1.25%. The risk loss in trading futures and options can be substantial. Past performance is not necessarily indicative of future results. A long […]

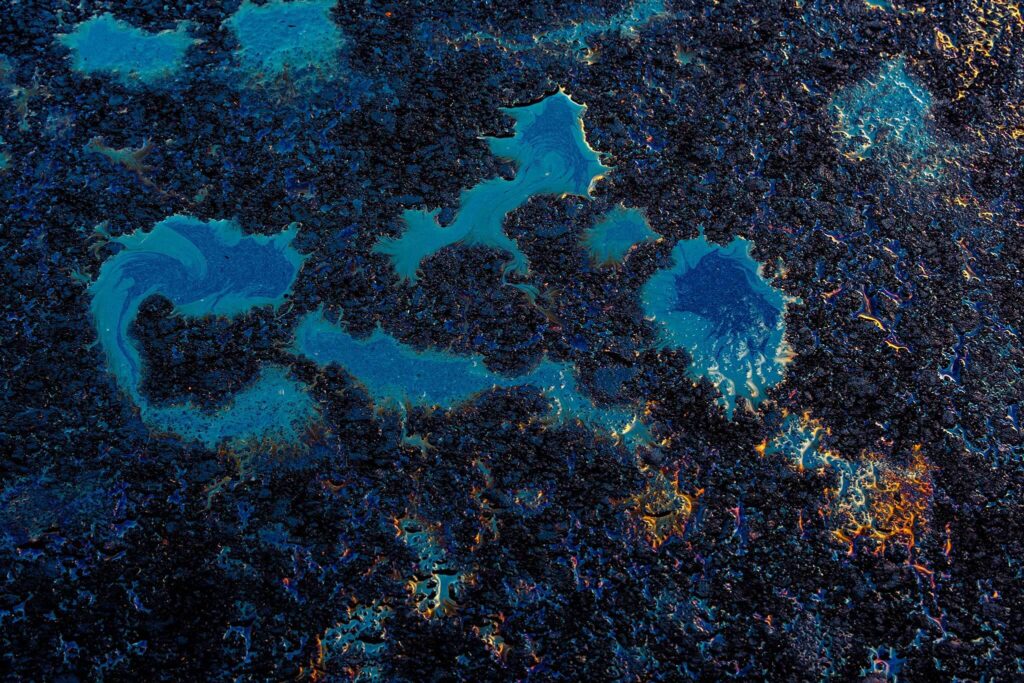

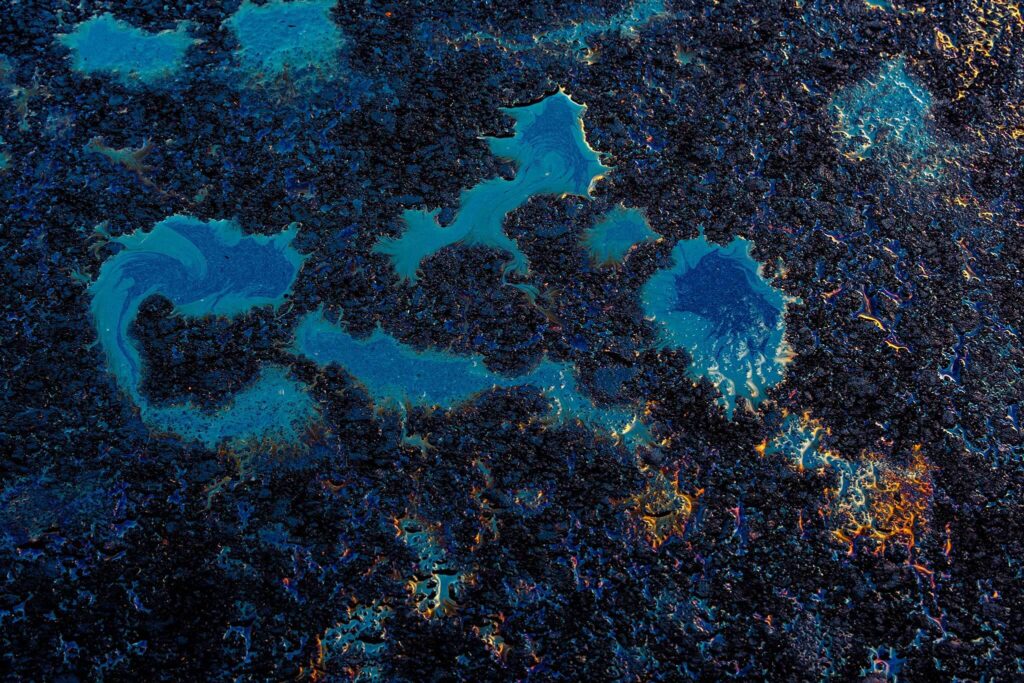

The Rush to Decarbonize

With COP26 underway, the discussion returns to how close each polluting nation can get to net-zero emissions (NZE) by 2050. This, the climate scientists suggest, is the only way to limit the pace of global warming to 1.5°C above pre-industrial levels this century. Not everyone is fully committed, but the general thrust is in this […]

Cayler Capital January 2022 Commentary

Commentary provided by Brent Belote of Cayler Capital We first turned bullish oil in April 2020, and I’m slowly starting to feel like it has run its course. We are still holding long positions, and prices will likely overshoot on the high side, but for the first time since the pandemic, we are starting to […]

AG Capital January 2022 Investor Update

Commentary by AG Capital Management Partners, LP Inflation It helps to go back to 10th-grade calculus class to understand inflation. Inflation is a rate of change (first derivative). For example, the latest headline number of 7% tells us that prices are rising on an annualized basis. What if inflation moves higher from here to 10% over […]

GZC Strategic Commodities Fund December 2021 Report

Commentary by GZC Investment Management Sell-side analysts and consultants remain extremely constructive, upgrading their oil price targets significantly for mid-year, and investor positioning has resumed in oil futures and options. At the end of Q3, the portfolio was positioned for upside risk as we entered the winter months; however, following further lockdowns due to Omicron […]

Numberline Capital Partners December Performance Report and Market Summary

Commentary by John Knott of Numberline Capital Partners. As we look back on the year, the program satisfied all the benchmarks we have set for ourselves. Although past performance is not an indication of what is to come, we exceeded our 15% performance target. In addition, we kept our max drawdown under 5%. This year the […]

AG Capital December 2021 Investor Update

Commentary by AG Capital Management Partners, LP Steady outlook We ended the year much as we performed all year long – one step forward, and one step back. That’s OK. In a year where our ideas have not come to fruition in a timely fashion, our job is twofold: first to question our fundamental themes and […]

GZC Strategic Commodities Fund November 2021 Report

Commentary by GZC Investment Management November 2021 will be remembered as a month of abrupt volatility for oil, remembering September 2019, when the Saudi Aramco attack propelled oil prices $10 higher at the market open. On the 26th of November, it was not a gap open per se, but prices started diving on news that […]

Mitigating ‘attachment bias’

Investors generally feel the pain from losses twice as much as pleasure from gains. Investment judgment is skewed by initial information or experience, and investors assign excessive value to what they already own in their portfolios. These were the main findings by Nobel Prize winner Richard Thaler1 who used psychology to explore the cognitive biases […]

AG Capital November 2021 Investor Update

Commentary by AG Capital Management Partners, LP The Discretionary Global Macro Program generated a 9.3% return, net of fees, in November 2021, leaving YTD performance at -1.4%. Too late Although the Omicron variant of coronavirus is capturing current headlines, it’s not top of the list of things we care about from a macro perspective. Instead, a […]

Numberline Capital Partners November Performance Report and Market Summary

Commentary by John Knott of Numberline Capital Partners. The Numberline Macro Risk Program was down 4.36% net of all fees for November and is up 19.37% year to date. Additionally, the program has returned 14.85% over the previous 12 months. These numbers are compiled by Turnkey Trading Partners. We left off last month worried about the […]

Have you seen our updated website?

Come check out our new features! With a site used by thousands over its 25-year history, IASG works very hard to make sure we stay relevant with updated features and the most free information available in our space. Our industry-leading database is used by the largest fund managers down to the next generation of traders […]

Greatest Sale Ending

The greatest sale on IASG is coming to an end as Adalpha Asset Management is changing their fee structure for new investors from 0/30 management and incentive fee to 1/20 effective January 1st, 2021. Gary Polony quietly traded this program since 2003 alongside his proprietary business before customer assets took off in mid-2019. Despite spending immense […]