Category: Economics

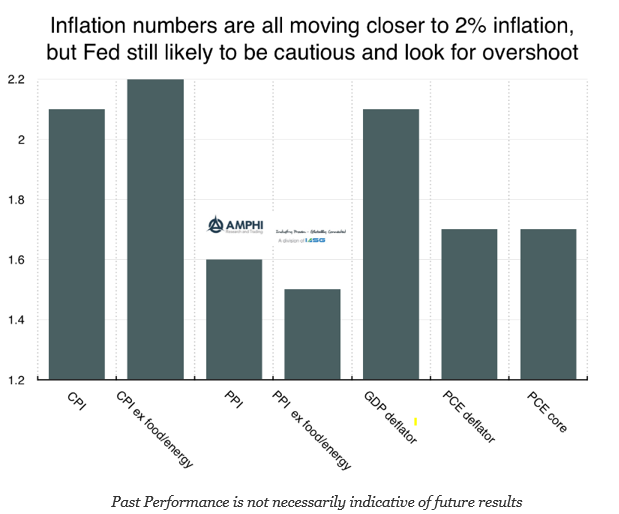

Inflation Closing in on Magic 2% or Bouncing Back

Current inflation numbers are all moving closer to 2%, but there is no special policy action from hitting or exceeding this rate. In fact, a cautious Fed is more likely with the most aggressive forecast being 2-3 rate moves. The Fed has not followed a mechanistic policy even though they have stated they are “data driven”. The most likely forecast will be to fade the earlier musings of the Fed.

From Populism to Macro Policy: The Regime Change of 2017?

Our commentary for the new year is not filled with predictions but describes an uncertain world of extremes for 2017. This uncertainty exists because the rise of populism seen in 2016 will have to be converted into macro policies during 2017.

Yield Trends Started Well Before Election

Yields exploded on the upside after the election and has seen one of the largest routs in recent years, yet it would be wrong to believe that this is all associated with the election. A close look at the trend sin yields show that the market broke above moving averages at the end of September. Using simple moving averages (20, 40, and 80-day), we would have called a change in bond sentiment weeks ago.

Commodities – Is This the Time to Allocate?

Commodities have been an out of favor asset class. With a long-term return downturn, that has only partially reversed, many have avoided commodities even though it has been one of the best performing asset classes for 2016. A return of over 5% through November 11th as measure day the DJP total return has made it a strong gainer albeit the reversal in oil has caused declines from highs earlier in the year.

3 Coping Strategies for Any Decision Process

The behavioral finance revolution has added immensely to our knowledge on the aberrations from efficient markets and rational expectations. Mistakes happen because we are sloppy thinkers.

Positive Skew

Skew can be an important component of returns. Obviously, investors would like to avoid negative skew, but if an asset with a positive skewed return distribution can be found, it can potentially generate a nice upside stretch with performance. Still, skew is sensitive to outliers and hard to measure. Skew is often generated from mixed distributions; nevertheless, if you can find positive skew investments and can associate this property with specific factors, portfolios can be structured to generate some extra upside return potential by increasing allocations to these assets.

The Deeper Dimensions of Economic and Financial Globalization: A Paradigm Shift in Investing

Economic and financial globalization is not just about trade. It is about trade only to the extent that trade includes goods, services, capital, labor, information, and culture. Globalization concerns the positioning of the firm and the individual in the world, not just the positioning within the nation-state or local economy. While globalization affects everyone, the […]

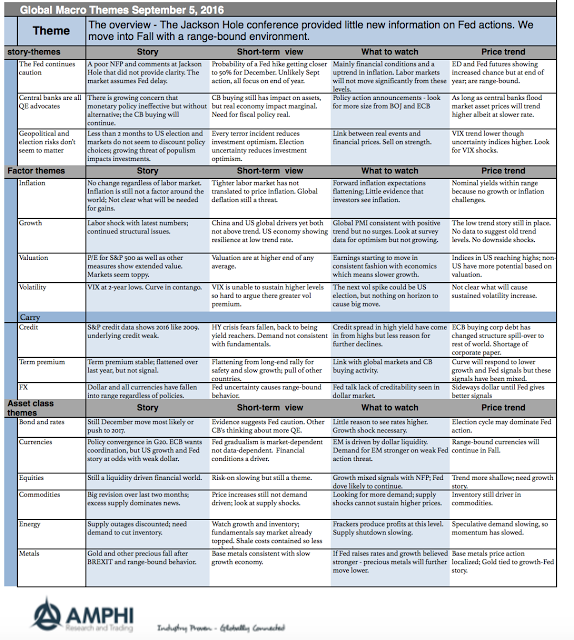

Global Macro on One Page for September

The major themes for September have not changed significantly from last month. The reason is simple. The markets have not moved much and the economic information that we have received in the last month has not changed expectations. The two big events were the Jackson Hole conference which provided little new light on Fed behavior and the confirm payroll last week which rolled back some of the real economic enthusiasm.

A Primer on Negative Interest Rates

In “Paradigm Shift” we suggested that the prevalence of negative interest rates on sovereign debt in Europe and Japan could indicate decline in the efficacy of central bank actions going forward. This article will elaborate on that premise by describing negative interest rate policy (NIRP) and why a central bank would employ such an unusual and experimental policy.

12 Questions to Ask Before Selecting a Commodity Trading Advisor

Here is a list that I’ve developed for Individual investors to know the answers to or ask before investing their risk capital with a Commodity Trading Advisor or Professional Money Manager. This checklist is ever evolving as new information comes to light or the dynamics change in the market place. Our hope in providing this […]

Federal Reserve Releases Beige Book and Chairwoman Yellen Speaks to Wall Street

The Federal Reserve gave the markets a double dose of talk and economic data Wednesday, but the market was already bullish and didn’t react much. First, the Fed released at 2 p.m. EDT the Beige Book Business Survey, which was based on data collected before April 7 and since the previous report on March 5. […]

All Eyes on the Fed

The world reacted very negatively on Thursday to the idea of a post-quantative easing economy. The oddest thing about the reaction to the Fed announcement was that not only did the stock market plummet but nearly all of the commodity markets fell just as aggressively despite the US Dollar strengthening. The big question now is whether or not the talk of tapering will effectively end the bull run of 2013, and where we go from here. With the market off the highs, sideways over the past few weeks, then sharply lower, it really is an interesting and difficult situation. The market showed us all how weak its legs really are.