Category: Global Macro

Breakout Funds – Interesting days ahead

What a wild past 27 hours across Macro. Yesterday was one of the most anticipated Fed meetings in memory. Markets were looking for a cut of 25 and hoping for more – either yesterday or in the near future. What we got was 25 and a bumbling press conference where Powell seemed to have no clue what was driving Fed policy at this point. The best we could take away was further trade uncertainty may result in those much begged for rate cuts. But this was just a guess, and that’s the point.

Trading Palladium: A Classic Macro Approach

Disclaimer: While investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and, in fact, result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies […]

Follow Howard Marks – Know where you are in the business cycle

Farago provides a useful framework for describing the great short book Mastering the Markets by Howard Marks. The Marks approach is simple but often not given enough attention. Know where you are in the business and credit cycle and you will make better decisions and miss blow-ups.

Information Usage and Decision-Making as a Classification Scheme

How do you classify global macro firms? There are a wide variety of hedge funds that call themselves global macro so a classification scheme may help distinguish possible return patterns.

The “New Global Macro” Thinking – It is About Your Ability to See and Exploit Networks

What has been the biggest change in thinking about global macro investing in the last ten years? Some could say it is the “anything is possible” view toward central banks. There is now nothing like normal central bank behavior. Others could say that it just the change in macro relationships which has made looking at old price relationship suspect.

Renaissance in Global Macro – It Is All About Global Disruption and “Creative Destruction” – Here Is One Avenue for Dislocation

Barron’s published a provocative piece from my friend John Curran, The Coming Renaissance of Macro Investing: The petrodollar system is being undermined by exponential growth in technology and shifting geopolitics. Coming: a paradigm shift. The concept behind this regime shift or dislocation ties together finance, technology, and global trade. Changes in the flow of trade based on shifting patterns of economic growth with disruptions in technology are going to spill-over to financial markets and prices. Capital flows are reactive to broader movements in power, politics, economic growth, and trade.

Bond Quality Down Further – Reason to Switch to Global Macro

Corporate spreads are tight and there is little room for further reduction given the absolute level of spreads. The reach for yield may be at an extreme. The bond spread is the compensation given bondholders for taking on the risk of corporate debt; consequently, it should become a concern when the quality of bond covenants or protections declines with spreads. Of course, if risk is declining, this is not the case, but at this point in the credit cycle it is hard to make that argument. An inverse relationship between spreads and covenant weakness means you are getting less compensation and less protection for the same risk, all things equal.

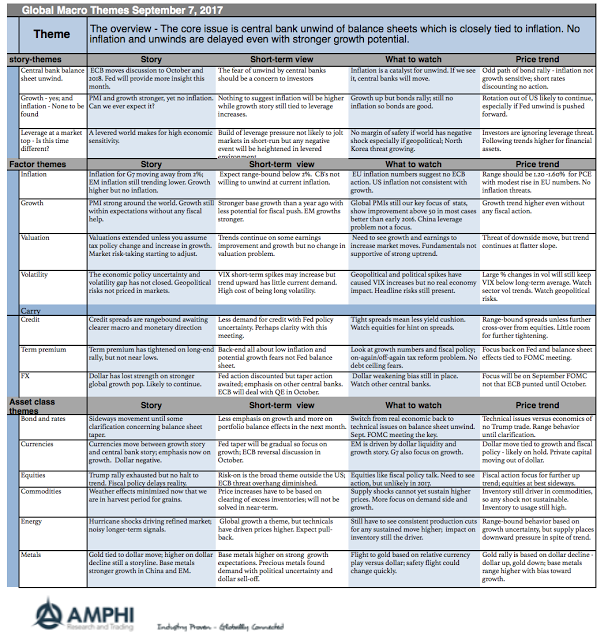

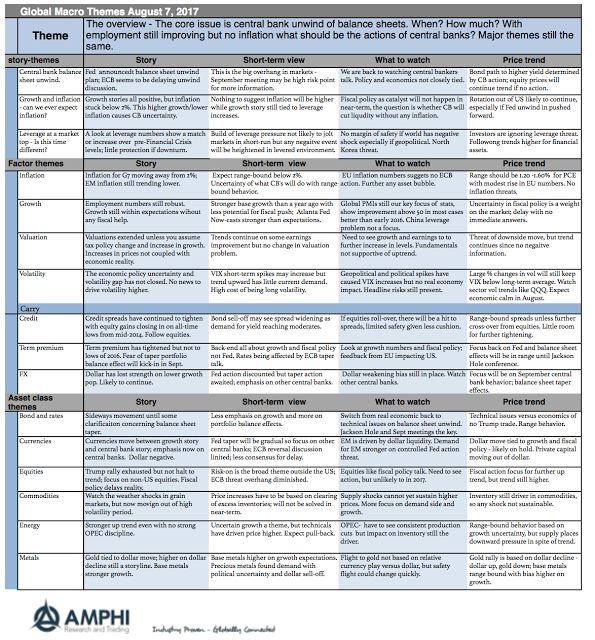

Global Macro in One Page – Where is that Inflation?

Where is that inflation? Central banks have this fixation on 2% inflation as both a goal and a signal. Policies have been structured for the magic 2% and signals for balance sheet action are based on the inflation hitting 2%, yet current inflation has not been able to reach this number. Growth expectations have been moved higher, yet there seems to be continued economic slack that will not allow product prices to push beyond 2%. Hence, central banks have held to current policies. (An exception was the Bank of Canada this month.) The result has been further asset price appreciation and more leverage. This combination will have to be adjusted, but not today. Nevertheless, markets are still hyper-sensitive to monetary policy musings.

Keeping it Simple with Explanations – An Investment Narrative needs to Answer Key Questions

There are two communication problems with global macro investing. First, the stories used to explain the global macro economy are confusing, contradictory, and haven’t proved to be true. This is an outgrowth of the poor forecasting of macroeconomics in general. Second, the stories used to explain the investment process especially for quants goes over the head of most investors. A discussion of techniques is not an explanation for how returns can be generated. Managers need to work on their narratives to ensure that investors understand what they do and why they make money.

Global Macro on One Page – The Complexity of Central Banking

How often are we going to hear about the overvaluation in equity markets? It already seems too much, yet talk is cheap because markets continue to trend higher. The focus should be on what events will cause this trend to reverse; nevertheless, a trend in place will stay in place until there is a reason to change. Unfortunately, a change in a trend usually comes from a surprise.

Global Macro on One-Page – All about Central Bank Balance Sheet Issues

What will be the key driver for global macro portfolios in the year’s second half? I hate to say it, but it will again be central bank behavior. I thought there was a switch to focus on the real economy with the Fed starting to raise rates and react to the macro environment. Still, markets […]

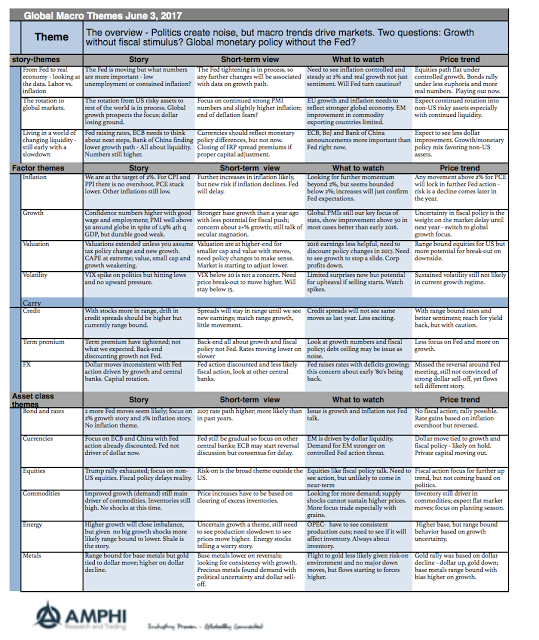

Global Macro in One Page – Forget the Noise and Watch the Numbers

As a more quantitative focused analyst, I keep focus one thing – the numbers. Stories are good, but numbers are better. At best stories, provide context for numbers, but stories of politics will not lead to market trends. Capital flows on trends in profits, growth, liquidity, and risk. Do not suffer from “shiny object” syndrome. The news of today may not impact the important fundamental trends.

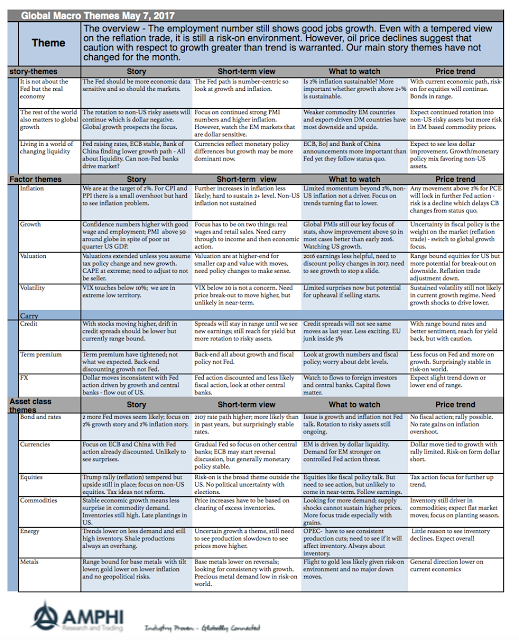

Global Macro on One Page – May 2017

The Fed and other central banks are not that important in the current thinking of investors. The focus is not on the policy musings of bankers but the real economic data. All that matters is whether growth has a strong chance to be above trend and whether global DM inflation has a chance of reaching and sustaining 2%. We are skeptics of both occurring.