Category: Investments

Where Do We Stand After the October Repricing?

The losses in October are well-known. Now the question is whether these down moves will continue across styles, sectors, country indices, and bonds. The answer with few exceptions is the same. Market trends are pointed down and volatility is higher. For equity styles, short, medium and long-term trends are all pointing down. For market sectors, the only positive trend is with consumer stables, utilities, and real estate; the more defensive sectors. For country equity indices, the only strong positive standout was Brazil in reaction to their presidential election. For bonds, short-term Treasuries offer some protection, but the longer-term trends are all down.

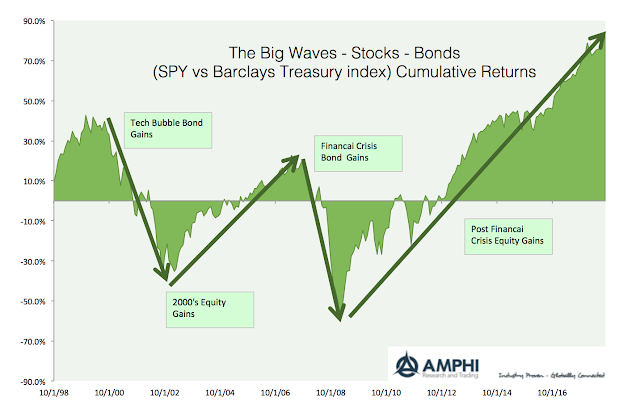

The Big Waves for Stocks, Bonds and Commodities – You Have to Exploit These Trends

Simple visuals can be very powerful at telling an effective investment story. I have compared equities, bonds, and commodity relative returns for the last twenty years to see the big wave cycles that investors needed to participate in to have a successful portfolio. The trends from these asset class cycles are long. An investor does not have to get in on the turning points, but they do need to hold the trends as long as possible. The secret to relative asset class success is commitment.

Don’t Worry About Investment Consultant Advice On Manager Performance – It Does Not Exist

How many times have you gone to a pension fund or endowment and heard the phrase, “You will have to check with my consultant”, or “If my consultant hasn’t approved you, I will not invest”. Pension consultants are powerful in the money management industry. Without their blessing, it is hard to grow an institutional money management business. There is the assumption by many that they have special investment powers that allow them to conduct due diligence and ferret information on managers that cannot be achieved my most others.

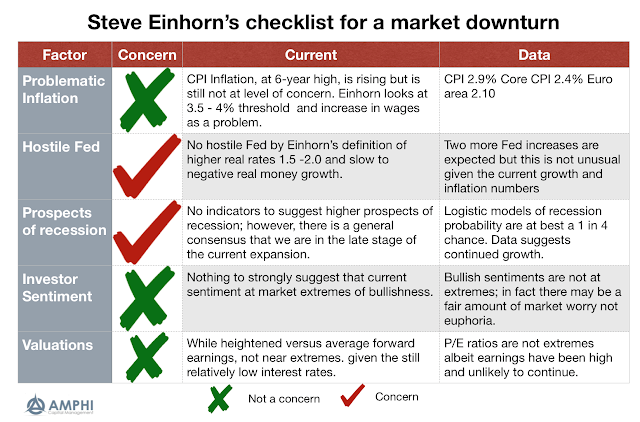

Steve Einhorn’s Checklist For A Bear Market – The Five Things You Need To Review

Recent interviews with Steve Einhorn, the long-time hedge fund manager, provides his checklist for when a bull market may turn into a bear market. It is not supposed to be a definitive forecast, but a good simple indication when conditions are ripe for a change. See Boyer Blog and Barron’s .

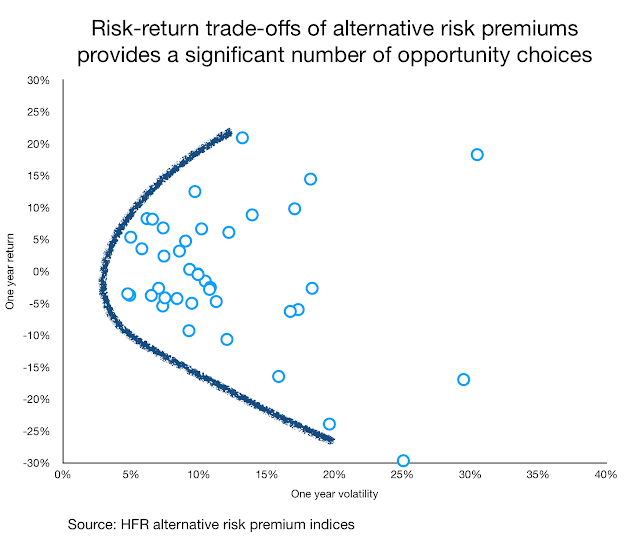

Alternative Risk Premium Indices – Providing insight on what is possible in the ARP space

HFR, the hedge fund index provider, announced a new set of indices based on alternative risk premium strategies generated from banks. This is a major advancement in transparency for investors and shows the strength in this growing sector of investing.

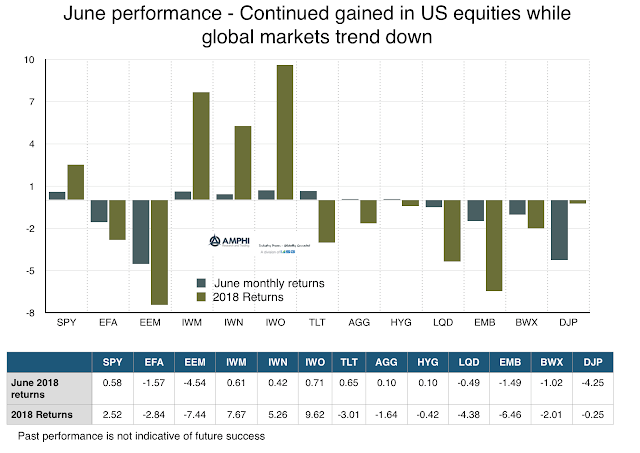

Hotter Financial Markets Will Match Summer Heat – But That May Not Be a Positive

There is a US/Global equity market disconnect. The higher US growth, optimism, and fiscal stimulus (tax and debt financing) have created a positive economic environment for the US that is not seen in the more lethargic global economy. US growth is expected to surge above 4% for the second quarter (per the Atlanta Fed nowcast) even with slight downward revisions for the first quarter. Global growth is not bad and is expected to exceed 2017, but economic shocks in the EU and EM and tightening China liquidity have all contributed to more fragile global stock markets. China equities, at least measured from the high, are in a bear market.

Downside Risks Abound – Beware of Summer Heat for International Investments

There is a large disconnect between US equities and global equities. The US equity markets seem out of touch with the financial difficulties seen in other parts of the globe, albeit recent price action suggests downside risks increasing. The gap between the small cap and emerging market indices is now above 15% for the first half of the year. Still, there are signs that the disconnect will not last as most styles have fallen below short-term (20-day) moving averages.

The Countable Non-Countable (quant versus narrative) Problem – Focusing on what is Important for Investing

“Not everything that can be counted counts, and not everything that counts can be counted.”

Is Investment Management a Science – Use the “Narrativeness” Test

“Narrativeness” may be defined as the quality that makes narrative not merely present but essential. It comes in degrees, and there are narratives without narrativeness. Since the time of Leibniz, Western thought has favored models in which abstract scientific laws would ideally account for everything in nature and society (the ideal of a social science) and in which narrative would therefore be, at best, merely illustrative. But a number of thinkers have presented forceful arguments that such an ideal of knowledge is a chimera. Darwin, Dostoevsky, Tolstoy, and others have insisted in the ineluctable need for narrative because genuine contingency exists and time is open.

The Rate of Return on Everything – What Does This Tell Us About Safe Assets? They Are Not Safe

The new paper The Rate of Return on Everything, 1870-2015 is a mammoth piece of research on gathering information on rates of return back through history. It seems like such a simple issue but producing this work required painstaking and diligent focus on obscure databases. This work is not often rewarded in the economics profession yet has powerful use.

“Likely” or “Probable” There is a Difference in the Language When you Start Talking About Recommendations in the New Year

I love this reformulated graph on the old work by Sherman Kent on the potential futility when using language to describe probabilities. There is a lot of ambiguity in the meaning of certain terms. One man’s doubt is not another’s “little chance” and one man’s “likely” is not another’s “probable”. If you use words, back them up with some numbers.

Old Behaviors Will Have to Change in New environment

“New eras are cut short by the financial behavior they reward and condition,” -James Grant. Too much of anything is not a good thing. Or, as stated by Herbert Stein, “If something cannot go on forever, it will stop.” All investment strategies fail or fall out of style at some point. The financial conditions and […]

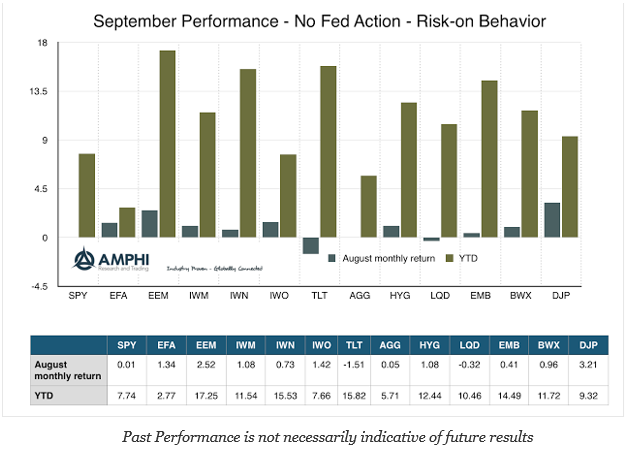

September Performance – Risk-On with Fed on Hold

Was investing for the month so simple? The Fed did not take any action, albeit the threat that they are getting close, and the markets rallied for the month. Fade the Fed regardless of their speeches about wanting to move rates higher. We think this strategy may be ending in December, but right now investors were again rewarded for not believing any threats of Fed action.