Category: risk management

US Navy and Risk Management – Follow the ABCD Process

The US Navy has an structured approach to risk management which is slightly different than the Marine Corps and US Army. See our posts on US Marine Corps and US Army risk management. The US Navy actually has a trifold brochure for Time Critical Risk Management. Would you ever expect to see this from a money manager? Certainly, the ABCD process is a loop for determining any trade or portfolio action.

Risk Management the US Marine Corp Way – It Is a Process

If you have to ask most people what is one of the riskiest professions, it is likely being a soldier. The downside is huge, death. The uncertainty of any battle situation is extremely high. No amount of planning can truly address the uncertainty and dynamic situations associated with battlefield situations. This uncertainty and risk is why training and risk management are so critical for armed forces.

Exits as Important as Entry Points? A Critical Issue

“I made my fortune by selling too early”, a quote from Baron Rothschild used for an investment game by John Hussman. John Hussman has invented a game called “Baron Rothschild” as a teaching tool which is based on a simple process of drawing returns from a set of cards The sequence of cards can generate a performance record. Think of this as a form of Monet Carlo simulation from a return distribution. The player can call stop after any number of picks or he can continue to pull return cards to compound his performance.

What are the Best Investment Warnings?

So what is a warning? A warning is defined as a statement or event that may indicate a danger, problem, or an unpleasant event. With hindsight, we can always find warning signs, but the real question is whether you can see warnings before the fact. The warning has to strong enough to change current thinking. For investments, a warning could be information that contradicts a given narrative. The narrative is the story that generates a specific trade or allocation.

Risk Hurdles

Risk management is more than applying quantitative tools to measure things like volatility or skew. It is an operational management problem of gathering and reporting data. The quality of risk management is related to the ability of a manager to properly aggregate data for analysis. Hence, strategies that have greater operational problems at gathering information on risk will have higher risk.

Surprises Happen – Black Swan, No

Tail events will often lead to over-reaction as seen in the market action overnight. The worth of a manager is not measured by his ability to build and adjust portfolios in calm times but his ability to navigate and manage through uncertainty.

Navigating uncertainty is not always taking action but at times learning to do nothing. Discussion with managers suggests that some systematic managers did not take model signals last night. Markets moves out of proportion to the discounted futures cash flows signaled that no action was best.

Managing uncertainty starts with core portfolio construction. Extra diversification is necessary when there is extra risk. Diversification may come through differences in timeframe and styles when correlations across asset classes have the likelihood of moving to one. Managers are paid to build portfolios, manage risk, and take action on changes in economic fundamentals, this cannot generally be done with passive investing.

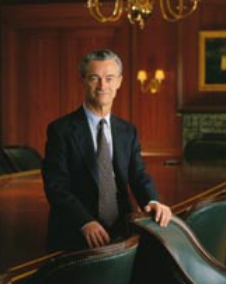

The Weatherstone Approach

Dennis Weatherstone, the former CEO and Chairman of JP Morgan had a special approach for deciding on the riskiness of new products. He would give the developers three 15 minute slots (45 minutes) to explain the product. His rule for approval would be simple. If the product could not be explained in the allotted time, […]

TED Spread Warning – Not What You Think

The TED spread has been used as financial market warning signal for decades although it has moved in and out of favor over time. Market participants have turned to other measure of financial risk, but when this old measure jumps, it is worth taking a closer peek.

The Clearinghouse, FCM’s, and the New DFP’s

The clearinghouse is the truly special feature of any futures exchange because it allows buyers and sellers to comfortably come together to trade with only limited credit risk. Traders know that they do not have to worry about the specific risk of their trade counter-party because their risk is with the clearinghouse. We know that the actual structures in place are more complex than this simple story. The mechanics make all the difference so changes should be looked at closely.

Overcoming Mental Biases in Trading and Investing

Average CTA’s, investors, and people generally have an overwhelming desire to be “right.” Who likes to be wrong? You read and hear daily from friends, and fellow traders (spouses – J), how important it is to be correct, especially when they make a market prediction or, even worse when they put real money into a […]

Still Neutral Sugar

Sugar #11- May15 Futures – In yesterday’s trading session Sugar future values were strongly influenced by the exchange rate movement in Brazil. This is the first time since March of 2004 that the dollar quote fell below $3, closing at R$2.967 (-1.3%).

Crude Oil: Potential Target in Focus

Crude oil bulls had a brilliant day on Thursday, with the oil complex posting strong gains. Brent crude finished at $64.83while WTI closed at $57.66. With the market sailing above the 100-day MA last week, a review of the continuation chart gives a perspective on what the bulls might be targeting in the longer term. […]

Energies: DOE Preview for Wednesday, 22 April 2015

Oil futures closed lower on Tuesday. June WTI finished the day down $1.26 at $56.62 a barrel while June Brent settled at $62.08 down $1.37 on the day. After being up each day last week and making new highs for the year, oil has been consolidating these gains early this week due to a lack […]