Tag: economy

What are Carrying Charges and how do they influence hedging decisions?

In order to fully get the “error” in selling grain at harvest and then buying calls to replace that grain, so as to still participate in possible higher prices you need to understand how carrying charges work in the grain markets. The definition of “carrying charges” is: an expense or effective cost arising from unproductive […]

Nat Gas: Summer Weather and Hurricane Season Begins

Written by: Bryen Deutsch The time has come for natural gas traders to refocus on US weather outlooks. June 1st marks the official start of hurricane season. While we did see an early season storm on the Atlantic seaboard a few weeks ago, the bulk of cyclone activity occurs during the next 6 months. The […]

Are You Interested in Becoming a Commodity Trading Advisor?

Services for CTAs Grow Your Business With Us You’re busy honing and perfecting your trades and strategies; you don’t have a lot of time for client acquisition or back office management. IASG can help. List your programs FREE on IASG.com and you’ll be introducing yourself to thousands of potential new customers and partnering with an […]

Start of Something Bigger in the S&P 500?

S&P Index futures fell by 1.11% today currently trading at 2105.50 lower by 19.00 points for the session, hitting a fresh 7 day low. The main talk amongst the trade were concerns about Greece and some positive economic data which again fueled expectations that a U.S. rate hike is coming sooner than later. How many times […]

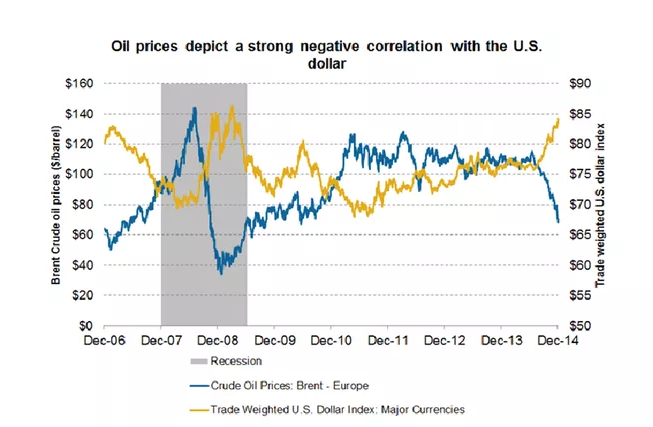

Don’t Be Fooled by Oil Bull Talk

Written by: Bryen Deutsch The 200-day moving average is a widely held long-term trend indicator. Markets trading above the 200-day moving average have a tendency to be in longer term uptrends. Markets trading below the 200-day moving average tend to be in longer term downtrends. Last July, the US Dollar Index crossed above the 200 […]

Soybeans: Will the Free Fall Continue?

Soybean values traded lower across the board today, with July 15’ settling at 9.22 ½ off 1 ¾ cents (New contract lows). Corn also showed weakness today, closing down 5 cents at 3.55, with Wheat values plummeting 21 ¾ cents, closing at 4.93 ¼, pegging in a new seven-day low. Rains continue to fall, which […]

Walmart Becomes Farm Friendly

Click the Link Below to watch the Full Story… Click Here

Oil’s Inside Week Suggests Imminent Breakout/Breakdown

Written by: Bryen Deutsch Last week both WTI crude and ICE Brent crude traded within the previous week’s range. This inside week was choppy and fairly uneventful as a second consecutive inventory draw reported by the EIA failed to drive the market to new highs. The chop fest continued Monday as the market closed slightly lower […]

How do you use Basis to Hedge?

Cash Price – Futures Price = Basis (at a specific point in time) A producer’s decision as to when and how to market their crops or livestock can have as significant an impact on their net bottom line profit as any production decision they may make throughout the year. Farmers today have more marketing alternatives […]

Overcoming Mental Blocks to Investing: Part 2

In my previous article, we reviewed the first seven of 13 “mental blocks” to investing an average CTA or investor may butt up against throughout trading or investing. To continue from where we ended off in the previous commentary, we will cover the final six biases and blocks that may affect how a CTA tests […]

Quiet Session in Soybeans. Calm Before the Storm?

A tranquil session today in the soybean market, with soymeal taking a backseat to oil. The nearby soybean spread May 15 vs. July 15 strengthened even with abundant total U.S. supplies in the picture. We have now seen Chinese imports lagging the year-ago pace for the last three consecutive months, with the cumulative seven-month import […]

Crude Bulls Running Out of Steam?

Crude bulls posted a new yearly high on Friday as WTI rocketed higher in the previous two sessions after Wednesday’s more bullish-than-expected DOE inventory release. More bullish?? Or less bearish might be more like it. Since making multi-year lows on March 18, WTI crude has seen a healthy 42% rebound. Likewise, Brent crude has rallied […]

Nothing New From The Fed

The myriad of bad economic news throughout the first quarter was punctuated today by the Commerce Department report that reported U.S. gross domestic product barely grew, only rising at a 0.2 percent annualized pace in the first three months of 2015. As usual, Federal Reserve officials sounded upbeat in their statement today, and as expected, there was […]