Tag: Gold

AG Capital: Fade to Famous

There’s something about being quoted in the Wall Street Journal or making it onto Bloomberg TV that often leads to terribly inaccurate judgement calls (at least in the short-term). A classic example of this is Ray Dalio’s famous interview from Davos in early 2018, where he declared that “If you’re holding cash, you’re going to feel pretty stupid” just before the market cratered -12% and potentially may have begun a topping process for the entire bull market run from 2009.

Breakout Funds – Interesting days ahead

What a wild past 27 hours across Macro. Yesterday was one of the most anticipated Fed meetings in memory. Markets were looking for a cut of 25 and hoping for more – either yesterday or in the near future. What we got was 25 and a bumbling press conference where Powell seemed to have no clue what was driving Fed policy at this point. The best we could take away was further trade uncertainty may result in those much begged for rate cuts. But this was just a guess, and that’s the point.

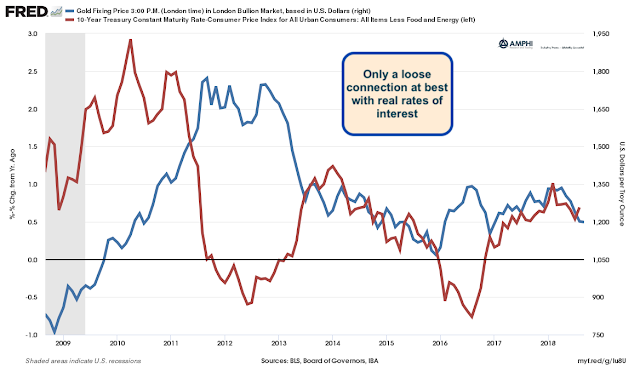

Gold – Not Be A Strong Link To Inflation Nor A Strong Relationship With Real Rates

We have written about the surprising lack of gold price gains with the surge in inflation. A reader has commented that it is the real rate of interest that is important, not inflation. Unfortunately, the data does not seem to show a close relationship.

Taking A Second Look At Gold During A Financial Crisis

What would have protected investors during the turmoil of last week? With all of the major asset classes falling, not much. Declines were a just a matter of degree. There were some selected instruments that did well, but the “correlation to one” effect, albeit not absolutely true, kicked-in for many assets that were supposed to provide strong diversification. However, there was a protection instrument that did provide safety, gold. Although slightly under bond returns for the Barclay Aggregate index through the first twelve days of the month, it has generated gains for the year and certainty beat long-term Treasury bonds.

Trading Gold Futures – CME vs. LME – This Could be an Interesting Battle

With a new regulatory environment, the traditional gold market is up for grabs. While many of the changes have not been direct to the gold market but based on a broader environment, regulation is changing the market structure for trading in gold. Regulations which increase the cost of trading over-the-counter has and will push gold trading onto exchanges, centralized counterparts (CCP’s). This environmental change is the opportunity for new exchange entrants in the gold market. We have already seen new trading through ETF’s over the last few years change gold dynamics and now there is the opportunity for changes in futures trading.

Was August the Calm Before the Storm?

Historically the summer markets coincide with tight ranges and low volume. Trends seem to dry up, markets trade in tight ranges, and short-term opportunities can be rare. For instance, the past 30-day range in the SP 500 has been the tightest range since 1995. That particular market led to a 180% rally in the stock market over the […]

Gold Spotlight: Cervino Capital Management LLC Gold Covered Call Writing Program

In 1971 President Nixon imposed a 90-day wage and price control program and other various expansionary fiscal policies in what became known as the “Nixon Shock”. More importantly, Nixon closed the gold window to prevent foreign governments that had been holding dollar-denominated financial assets from demanding gold in exchange for their dollars. By January 1976 […]