Tag: grains

Grain Basics 101

Many of my favorite traders focus on the grain markets. After all, we all need food, so the demand is more inelastic compared to many markets and, therefore, less sensitive to financial market conditions than most commodities. We rarely need to think much about where it comes from until recently when we realize that our […]

Commodities: A Range of Opportunities for 2021 – Market Outlook

“With a new secular bull trend, Commodities are among the most attractive markets this year. This commodity environment could be an exceptional moment to be in a spread program.” The economic pendulum tends to be swinging towards commodities. The notion that low commodity prices are their own cure may be playing out in 2021[1], with […]

COMMODITIES A RANGE OF OPPORTUNITIES FOR 2020

We consider grains to be one of the most exciting markets for this year, an increase in the U.S. grain export will support prices, but only if the U.S. dollar stabilizes or declines. Corn and Wheat seem to be at a discount from their previous years’ price average; a definitive US-China trade deal could impact grains to have sharp moves in the year. We also anticipate an inflow of institutional money into grains that will move futures prices of different expiration. This is an optimal environment for our trading program.

Call Option on Weather Shocks Through Agricultural Managed Futures Managers

There is the potential for a major agricultural price dislocation if a strong La Nina effect lasts through the summer. It is unclear whether the current La Nina effects will continue, and current expectations are that it will dissipate in the spring, but history suggests that ENSO effects can disrupt many major commodity prices including corn, soybeans, wheat, coffee, and sugar. So how can investors take advantage of this uncertain opportunity?

Protecting Yourself in a Locked Limit Market: Utilizing Synthetic Futures Positions

A futures or commodity market is a “locked limit” when trading is suspended due to prices moving the exchange-stipulated daily limit. This can happen for one day (it can even lock-limit and then trade-off), or if given a news event monumental, the market may stay “locked” for as many days as needed for market participants […]

Are You Interested in Becoming a Commodity Trading Advisor?

Services for CTAs Grow Your Business With Us You’re busy honing and perfecting your trades and strategies; you don’t have a lot of time for client acquisition or back office management. IASG can help. List your programs FREE on IASG.com and you’ll be introducing yourself to thousands of potential new customers and partnering with an […]

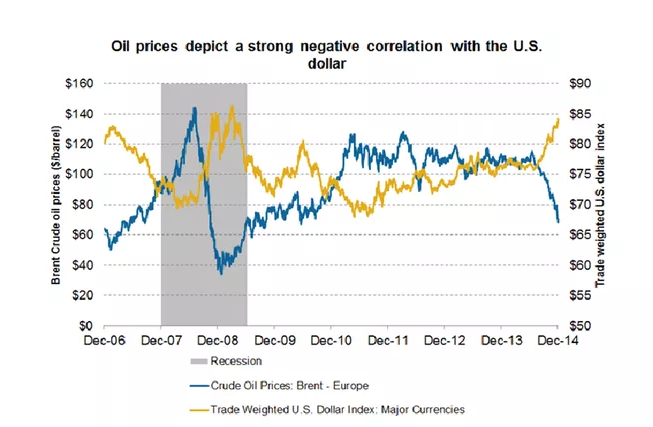

Don’t Be Fooled by Oil Bull Talk

Written by: Bryen Deutsch The 200-day moving average is a widely held long-term trend indicator. Markets trading above the 200-day moving average have a tendency to be in longer term uptrends. Markets trading below the 200-day moving average tend to be in longer term downtrends. Last July, the US Dollar Index crossed above the 200 […]

Soybeans: Will the Free Fall Continue?

Soybean values traded lower across the board today, with July 15’ settling at 9.22 ½ off 1 ¾ cents (New contract lows). Corn also showed weakness today, closing down 5 cents at 3.55, with Wheat values plummeting 21 ¾ cents, closing at 4.93 ¼, pegging in a new seven-day low. Rains continue to fall, which […]

Corn Values Remain Stable after Report

Corn: (July Corn Futures) – Values managed to edge higher by ½ cent on today’s session, settling at $3.61 even after the USDA analysts chose not to upwardly adjust new crop yield estimates leaving them at 166.8 bu/acre. This is the second-highest yield now on the books, however, the trade may see this as a […]

Is Selling Corn the Way to Go? Update: April 21st 2015

Corn values sagging in early trade, with the May 15 contract currently trading at 3.72 ¼ lower by 5 ¾ cents with the new crop contract at 3.96 ¼ down 5 cents, pegging the May 15 vs. Dec15 (Old crop / New crop) spread at 24 cents. The Funds continue to add to their short […]