Tag: inflation

Inflation Coming?

Want to play a “fun” game? Go to Google and type “currency crisis (insert any country name)” and see your results. Luckily for Americans, you will find that the United States is one of the few countries that have avoided this designation so far. As one of my Polish friends who immigrated asked me, “Why […]

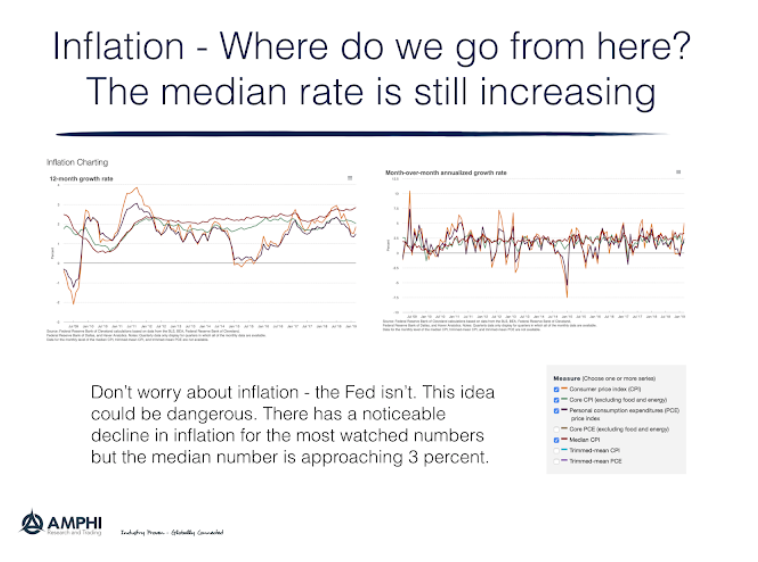

Inflation – Where do we go from here?

Don’t worry about inflation – the Fed isn’t. Or, the Fed believes there is no value is trying to get ahead of any inflation increase given the relatively tight range for inflation. The market penalized any fixed income investor that acted on inflation fears. Any Fed objective function has a higher weight on growth.

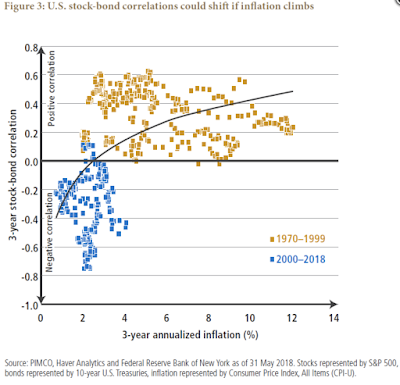

When Inflation Moves Higher – What To Expect With The Stock-Bond Correlation

The single largest diversification play for investors over the last two decades has been the strong negative correlation between stock and bonds. There are portfolio managers and investment analysts who have spent their entire career under the negative stock-bond correlation advantage, yet times change. Finance’s greatest “free lunch” is not a one-sided bet. Older managers can impress young analysts even in their forties of old tales of “back in the day” when stocks and bonds moved together. Some may argue that elders who talk of this should be retired and just let the new guys run things, but investors should discuss and prepare for alternative equity/bond environments.

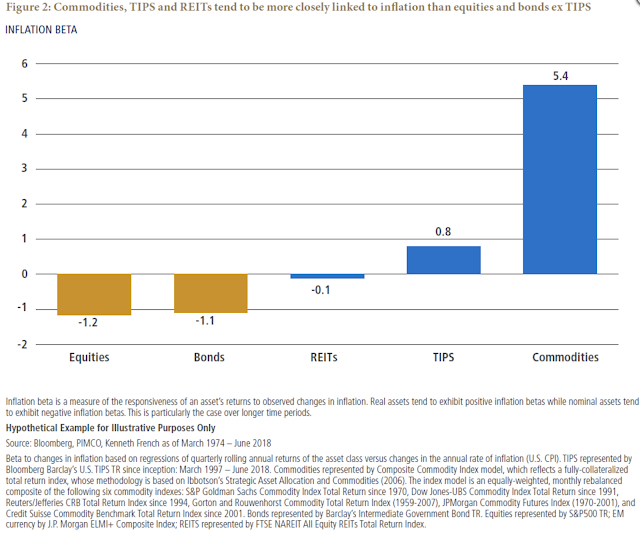

How Much Inflation Beta Do You Want? Likely More Than What You Have

There is a correlation between commodity investing and inflation. Commodities do well late in the business cycle when bonds usually underperform and inflation is heightened. Research work by PIMCO measures the inflation beta for some major asset classes. Stocks have a negative inflation beta even though earning should rise with inflation. Bonds as a nominal asset show a strong negative beta. Real estate which should be a real asset is neutral to inflation. TIPS have a beta that is close to one which is consistent with the underlying construction of the security. Commodities have a very large inflation beta that can be used to take advantage of inflation concerns. Still, this high inflation beta may be a concern for some investors.

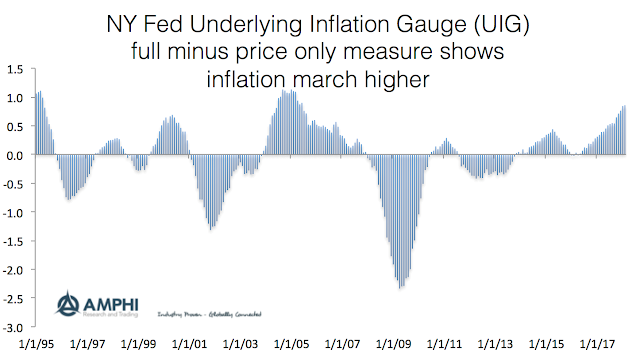

Inflation is Here – Now Focus on the Next Question, Where is it Going

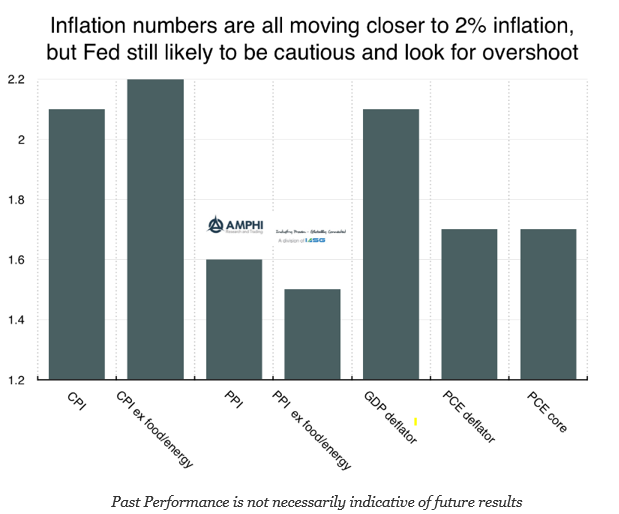

Inflation is here. There is no doubt, but that number will be around 2%. The only question that is unclear is whether there will be overshoot beyond the 2% level. Clearly inflation in the Eurozone is still not near 2%, but all inflation placed bets seem to surround the target level that have set by central banks. Investors have to ask the simple question of whether the beyond 2% is realistic.

Oh My Bonds

“Oh my god, the unemployment rate is below the natural rates, sell your bonds!”

This has been the usual bond market reaction for the last few decades, but the world has changed. There may be good reasons to sell bonds, but a low unemployment rate may not be the main driver. Investors need to kill off the idea of the natural rate of unemployment or at least modify their views. That does not mean that bonds will not react to low unemployment rates, but the current sensitivity is significantly different than what we have seen in the past.

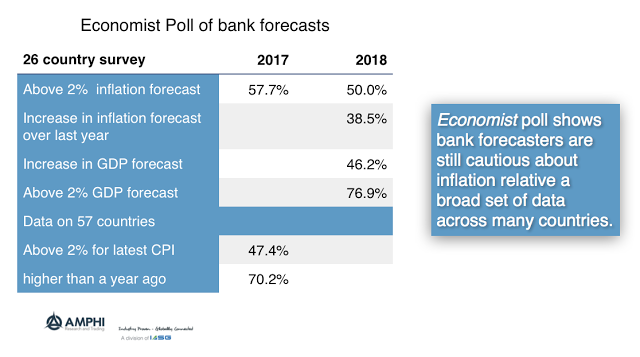

Still Caution with Inflation Forecasts Even If Trends Are Higher – Big Question Is Whether You Bet Against the Caution

Inflation is becoming a greater concern with many investors, but forecasters are more mixed with their views. The latest CPI number posted a 2.1% year over year change and the core CPI showed a 1.8% change. CPI has been above 2% for 8 of the last 12 months; however, both the CPI and core CPI changes were higher last January. These numbers are stabilizing at a higher level around 2% although there is not a run-away threat with the actual numbers or market expectations.

Commodity Investing – What is it all About?

What is commodity investing all about: 1. The curves and carry – backwardation/contango (inventory). Given the cash market for commodities is often not available for investing, the primary market for investors in commodities is the futures. Consequently, the shape and dynamics of the futures curve is a dominant factor for longer-term investing. Investors cannot think […]

Inflation Closing in on Magic 2% or Bouncing Back

Current inflation numbers are all moving closer to 2%, but there is no special policy action from hitting or exceeding this rate. In fact, a cautious Fed is more likely with the most aggressive forecast being 2-3 rate moves. The Fed has not followed a mechanistic policy even though they have stated they are “data driven”. The most likely forecast will be to fade the earlier musings of the Fed.

Yield Trends Started Well Before Election

Yields exploded on the upside after the election and has seen one of the largest routs in recent years, yet it would be wrong to believe that this is all associated with the election. A close look at the trend sin yields show that the market broke above moving averages at the end of September. Using simple moving averages (20, 40, and 80-day), we would have called a change in bond sentiment weeks ago.

Commodities – Is This the Time to Allocate?

Commodities have been an out of favor asset class. With a long-term return downturn, that has only partially reversed, many have avoided commodities even though it has been one of the best performing asset classes for 2016. A return of over 5% through November 11th as measure day the DJP total return has made it a strong gainer albeit the reversal in oil has caused declines from highs earlier in the year.