Tag: Market Trend

Market Trends for May – Some Developing Strength

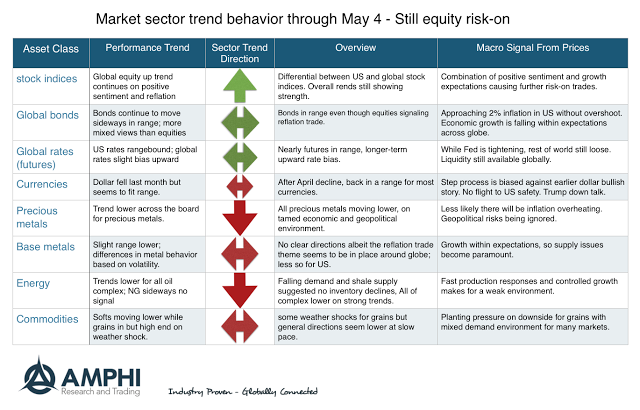

Going into the month, there are good up trends in place with global equities and down trends in oil, precious metals, and selected commodities. What is interesting is the inconsistency across some markets sectors. The reflation risk-on trade is still apparent in the global equity indices, but we are not seeing strong evidence of bond sell-off or rally. Oil prices suggest both supply strength and demand weakness. Gold and precious metals are out of favor with long-only investors. The idea that we will have a dollar rally on Fed hikes seems misplaced and there is less risk-on demand for the US relative to the rest of the world.

Goldman Management – CTA performance commentary June 2014

In the first three weeks of May the S&P’s trading range was extremely compressed at roughly 1% with the previous 13 weeks having been limited to a 5% range, representing a measure of suppressed volatility that has not been seen in 8 years. In addition, numerous volatility measures also moved to the lowest levels in years, as is the case with VIX, which fell below 11 last month, the lowest since February 2007. Entering the month of June the S&P broke above this narrow range and advanced in the first three weeks despite the turmoil in Iraq. The S&P has rallied in the last two months without a single daily gain or loss +/- 1%, a rarity as well, with a prior occurrence in 1995. Furthermore, the S&P finished in the top 25% of the daily trading range (the S&P point change from the previous day/ the S&P daily range) in the first 20 trading days of the month, which is an unusual occurrence, having been seen less than a dozen times in the past 55 years. This trend continued into month end, driving the 40 day average of the formula into the top 31% of the daily range. This has occurred just one other time going back 55 years, having last manifested in the middle of May, 1995. The present backdrop is different than in May 1995 as the S&P then traded sideways the previous year and experienced a 10% correction induced by the Federal Reserve raising rates.