Tag: oil

Oil Drillers Won’t Drill

One might think that $120 a barrel oil would be incentive enough to start drilling and increase refinery capacity. Still, it appears energy producers are taking politicians at their word when they say they want to eliminate their industry. When the stated goal in Europe and the United States is to phase out fossil fuels […]

Commodities: A Range of Opportunities for 2021 – Market Outlook

“With a new secular bull trend, Commodities are among the most attractive markets this year. This commodity environment could be an exceptional moment to be in a spread program.” The economic pendulum tends to be swinging towards commodities. The notion that low commodity prices are their own cure may be playing out in 2021[1], with […]

Sigma Advanced Capital – Disruption in the Energy Markets

Today Oil surged around 14% after the Saturday attack on Saudi Arabia Oil processing complex Abqaiq. Meanwhile, there is uncertainty as to if the Aramco will be able to restore full capacity, while the US is blaming Iran for the aerial attacks, increasing geopolitical Risk.

12 Questions to Ask Before Selecting a Commodity Trading Advisor

Here is a list that I’ve developed for Individual investors to know the answers to or ask before investing their risk capital with a Commodity Trading Advisor or Professional Money Manager. This checklist is ever evolving as new information comes to light or the dynamics change in the market place. Our hope in providing this […]

What are Carrying Charges and how do they influence hedging decisions?

In order to fully get the “error” in selling grain at harvest and then buying calls to replace that grain, so as to still participate in possible higher prices you need to understand how carrying charges work in the grain markets. The definition of “carrying charges” is: an expense or effective cost arising from unproductive […]

Understanding Risk-to-Reward Ratios in Trading: A Key Factor for Success

When you trade the markets, you don’t know the exact probability of winning or losing on a given trade. You won’t know how much you will profit or lose. A CTA does extensive historical testing on their concepts and trading strategies to understand what to expect. They will also pull huge data samples of market […]

Bulls Being Lured in With Dropping Rig Counts

CNBC is running out of credible, bullish analysts on the oil complex. The calls for $65+ WTI seem relatively sparse. Is anybody in their right mind still thinking crude oil is going higher? Of course. We all know Keynes’ saying, “The market can stay irrational longer than you can stay solvent.” But seriously, how much […]

Measuring the Edge of Entry Signals in Trading

When a CTA or Money Manager is testing or back-testing their entry signals, one of the most important aspects they look at is if the technique’s they are using have a distinct “edge” for the time frame they are trading (short-term, swing, long-term, etc.). Positive price movement is when the market goes in the direction […]

Nat Gas: Summer Weather and Hurricane Season Begins

Written by: Bryen Deutsch The time has come for natural gas traders to refocus on US weather outlooks. June 1st marks the official start of hurricane season. While we did see an early season storm on the Atlantic seaboard a few weeks ago, the bulk of cyclone activity occurs during the next 6 months. The […]

Are You Interested in Becoming a Commodity Trading Advisor?

Services for CTAs Grow Your Business With Us You’re busy honing and perfecting your trades and strategies; you don’t have a lot of time for client acquisition or back office management. IASG can help. List your programs FREE on IASG.com and you’ll be introducing yourself to thousands of potential new customers and partnering with an […]

Start of Something Bigger in the S&P 500?

S&P Index futures fell by 1.11% today currently trading at 2105.50 lower by 19.00 points for the session, hitting a fresh 7 day low. The main talk amongst the trade were concerns about Greece and some positive economic data which again fueled expectations that a U.S. rate hike is coming sooner than later. How many times […]

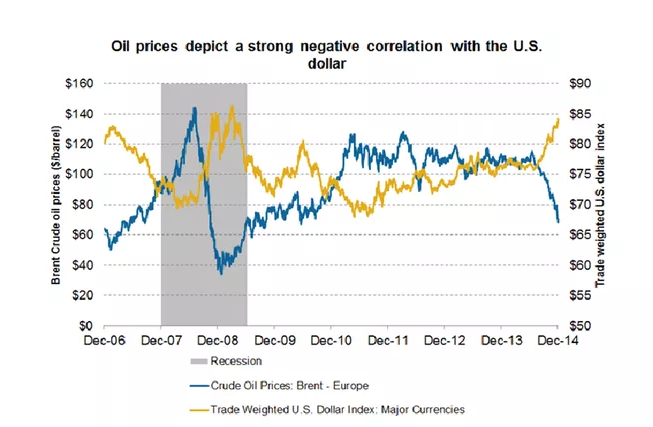

Don’t Be Fooled by Oil Bull Talk

Written by: Bryen Deutsch The 200-day moving average is a widely held long-term trend indicator. Markets trading above the 200-day moving average have a tendency to be in longer term uptrends. Markets trading below the 200-day moving average tend to be in longer term downtrends. Last July, the US Dollar Index crossed above the 200 […]

Soybeans: Will the Free Fall Continue?

Soybean values traded lower across the board today, with July 15’ settling at 9.22 ½ off 1 ¾ cents (New contract lows). Corn also showed weakness today, closing down 5 cents at 3.55, with Wheat values plummeting 21 ¾ cents, closing at 4.93 ¼, pegging in a new seven-day low. Rains continue to fall, which […]