Tag: Risk Premia

From Hedge Funds to Passive Investing: The Need for a Paradigm Shift in Endowments

Endowments are supposed to be the smart money, yet if you review the recent exhaustive paper on return performance, you will get a different impression. Large endowments do better than small endowments, but when you compare with a simple 60/40 stock bond balanced fund, there is not a lot of alpha generated. See “Investment Returns and […]

Can You Improve on the 60/40 Stock/Bond Allocation Without Changing the 60/40 Allocation?

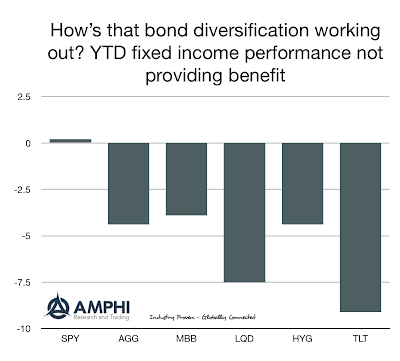

The classic 60/40 stock bond asset mix has proven to be a good core asset allocation. When in doubt, employing the simple 60/40 (SPY/AGG) asset mix as a base case has been an allocation that has performed well versus other diversification strategies. This allocation bias may be coming to an end.

No Diversification in Mudville – Time To Try Different Risk Premia Styles

Diversification is usually thought of as a longer-term concept. Don’t worry if it seems like you are not receiving diversification in a given month or quarter. Think about diversification across a longer horizon. Diversification also does not guarantee better returns for a portfolio. Negative diversification does mean that your losers will be offset with winners.

Blending Risk Premia and Generating Craftsman Alpha

Alpha generation will fall when it is measured correctly through an appropriate benchmark. Alpha shrinkage over the last ten years is a measurement problem. Returns for hedge funds are a combination of the underlying risk premia styles employed and the skill of the manager.

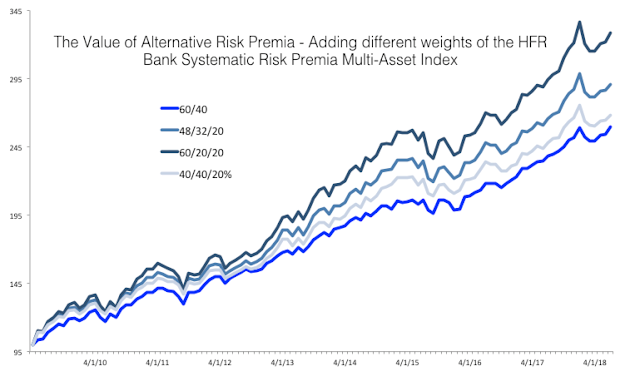

Simple Alternative Risk Premia (ARP) Allocation – You Get Value

Investments in alternative risk premia (ARP) are way to access the important building blocks for returns and generate return streams that will not be highly correlated with market beta exposures. Through factors and styles like value, carry, momentum, and volatility, investors can generate unique return streams relative to asset class betas. To show the value of alternative risk premia, we have taken a broad based index constructed from HFR through bank swap products and compared against a standard 60/40 stock/bond index. The HFR index is new and represents only a portion of the growing ARP market and may not include the largest banks. Still, it may provide some insight on what realistic value can be added through investing in a portfolio of risk premia.

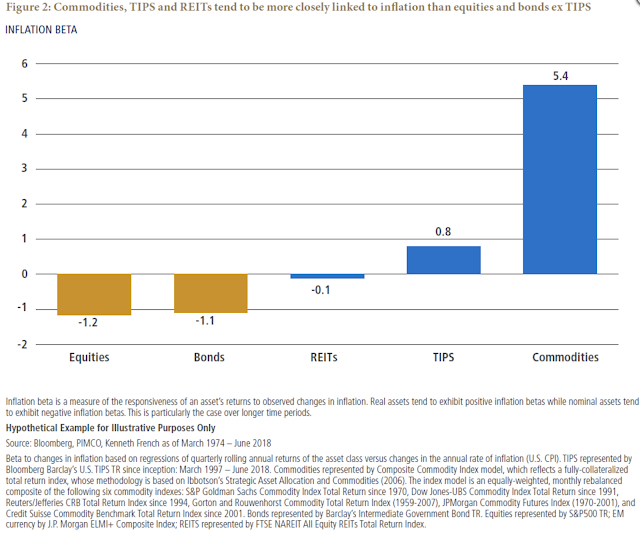

How Much Inflation Beta Do You Want? Likely More Than What You Have

There is a correlation between commodity investing and inflation. Commodities do well late in the business cycle when bonds usually underperform and inflation is heightened. Research work by PIMCO measures the inflation beta for some major asset classes. Stocks have a negative inflation beta even though earning should rise with inflation. Bonds as a nominal asset show a strong negative beta. Real estate which should be a real asset is neutral to inflation. TIPS have a beta that is close to one which is consistent with the underlying construction of the security. Commodities have a very large inflation beta that can be used to take advantage of inflation concerns. Still, this high inflation beta may be a concern for some investors.

Alternative Risk Premia Showed Varied Performance Over The Last Year

The new HFR bank systematic risk premia indices provide a wealth of information on this growing and important investment area. All alternatives risk premia are not created equal. A review of the return performance over the last year shows that there were clear winners and losers.